How Sudden Wealth Turned Into Total Loss

The dream of waking up to a bank balance filled with millions is a universal fantasy that many of us indulge in while clutching a crinkled paper ticket. We imagine the freedom of quitting the daily grind and the joy of providing for those we love, yet the reality of sudden wealth often carries a hidden weight that most people are simply unprepared to carry. Money has a peculiar way of magnifying existing problems rather than solving them, and without a solid emotional or financial foundation, a massive windfall can quickly transform from a blessing into a complex burden that dismantles a person’s entire life.

Exploring these cautionary tales is not about judging those who struggled, but rather about understanding the fragile relationship between human nature and immense fortune. It matters because it highlights the necessity of financial literacy and the importance of maintaining one’s character when the world suddenly offers every temptation imaginable. As we look through these stories of rags to riches and back to rags again, we see a recurring theme of how easily a lifetime of security can vanish when wisdom does not keep pace with wealth.

Jack Whittaker’s Heartbreaking Spiral

Andrew Jackson Whittaker Jr. was already a millionaire when he won a staggering 315 million dollars in the Powerball back in 2002, yet his life took a dark and tragic turn almost immediately after his win. While he was initially celebrated for his generosity and his desire to help his local community, the sheer scale of the attention he received became a magnet for criminals and personal misfortune. He suffered through a series of high-profile robberies where thieves snatched hundreds of thousands of dollars from his vehicle while he visited various establishments, and he soon found himself embroiled in endless legal battles that drained both his spirit and his once-vast fortune.

The personal toll was even more devastating than the financial losses because the money seemed to bring a curse upon his family members who struggled with the sudden change. His granddaughter, whom he adored and frequently gifted with large sums of money, tragically fell into a cycle of addiction and was eventually found dead under mysterious circumstances which shattered his heart. By the time he passed away in 2020, the man who once held the largest jackpot in history had lost his daughter, his granddaughter, and almost every penny of his winnings. It serves as a somber reminder that no amount of cash can protect a family from the vultures of the world or the internal struggles that wealth often exacerbates.

Janite Lee’s Generous Downfall

Janite Lee was an immigrant from South Korea working in a wig shop when she won 18 million dollars in the Illinois lottery in 1993, and she used her newfound wealth to become one of the most philanthropic winners in history. Unlike many who spent their money on lavish cars or mansions, Janite was driven by a genuine desire to improve the lives of others and donated massive sums to educational institutions and political causes. She was even photographed with prominent world leaders and became a well-known figure in high-society circles because of her incredible kindness and her willingness to fund community projects that lacked the necessary resources to survive.

However, her altruism was not matched by a plan for long-term financial sustainability because she gave away her money much faster than it could ever grow through investments. Within just eight years of her massive win, the woman who had been so selfless was forced to file for bankruptcy with only a few hundred dollars left in her bank account and millions in debt. She had sold the rights to her annual payments for a lump sum to fund her giving, but without professional guidance, she found herself with nothing left to support her own life. Her story is a poignant example of how even the best intentions can lead to ruin if they are not balanced with a sense of self-preservation and careful financial management.

William Post’s Family Betrayal

William Bud Post III had just over two dollars in his pocket when he won 16 million dollars in the Pennsylvania lottery in 1988, but his victory was the beginning of a living nightmare that would last for years. Within weeks of receiving his first payment, his own brother was arrested for allegedly hiring a hitman to kill him and his wife so that he could inherit the fortune. This level of betrayal was only the start of his troubles as he was hounded by lawsuits from former girlfriends and family members who felt entitled to a piece of his luck. He spent money recklessly on aeroplanes and businesses that failed, further complicating his life.

The pressure of the money was so intense that Post eventually declared that he was much happier when he was completely broke and living on social security payments. He faced a series of legal troubles and even spent time in jail for firing a gun over the head of a debt collector who came to his property. By the time he passed away in 2006, he was living on a very modest monthly stipend and left behind a legacy of caution regarding the way wealth can destroy the bonds of kinship. His life proves that while money can buy many things, it often attracts the worst kind of attention from the people you should be able to trust the most.

Callie Rogers’ Youthful Mistakes

Callie Rogers became the youngest ever lottery winner in the United Kingdom when she scooped nearly 1.9 million pounds at the tender age of sixteen in 2003. At such a vulnerable age, she lacked the maturity to handle the sudden influx of cash and the intense public scrutiny that followed her every move. She spent hundreds of thousands on designer clothes, parties, and cosmetic surgeries while also giving away large portions of her winnings to friends and family who were more than happy to take advantage of her naivety. The pressure of being a teenage millionaire led to deep bouts of depression and several attempts to take her own life as she felt isolated.

Looking back years later, Callie has often spoken about how the win was more of a curse than a blessing because it robbed her of a normal upbringing and the chance to find herself without the influence of money. She eventually burned through the entire fortune and ended up living on benefits while working as a carer to support her children. Despite the loss of the money, she has expressed a sense of relief at being broke because it allowed her to find true happiness and genuine relationships that weren’t based on her bank balance. Her experience has prompted calls for the lottery age to be raised so that other children are not exposed to the same level of risk.

Luke Pittard’s Family Values

Luke Pittard was a young man from Wales who won 1.3 million pounds in 2006 and proceeded to spend a large portion of it on a lavish wedding to his partner Emma and a luxury trip to the Canary Islands. The couple also bought a beautiful new home together, but they soon discovered that the life of leisure was not nearly as fulfilling as they had imagined it would be while they were both still young and capable of working. Without a daily routine or a sense of purpose, Luke found himself becoming bored and lonely while his friends and his wife were occupied, and the thrill of the win faded much faster than he had anticipated when he first held that winning ticket.

In a move that stunned the British tabloids, Luke decided to return to his old job flipping burgers at a local Burger King because he missed the social interaction and the simple satisfaction of a hard day’s work. His wife Emma was incredibly supportive of his decision to return to the workforce, as they both realised that money could not replace the human connection and the sense of belonging they felt in a regular environment. They became a symbol of a different kind of lottery story where a couple chooses a humble life and a steady routine over the hollow glitz of the high-roller lifestyle. Eventually, the money dwindled as they lived a normal life, but they remained vocal about the fact that they were much happier with a familiar routine and each other.

Evelyn Adams’ Double Loss

Evelyn Adams defied incredible odds by winning the New Jersey lottery not just once, but twice in the mid-1980s, collecting a total of roughly 5.4 million dollars. One would think that winning twice would provide a double layer of security, but for Evelyn, it simply provided more fuel for a devastating gambling habit that would eventually consume everything she owned. She was a regular at the casinos in Atlantic City where she was treated like royalty as she wagered thousands of dollars at a time on the tables. The thrill of winning the lottery seemed to convince her that she was untouchable and that her luck would never truly run out.

Unfortunately, the house always wins in the end and Evelyn managed to gamble away every single cent of her multi-million dollar prizes within a relatively short period of time. By the early 2000s, she was living in a trailer park and reflecting on the mistakes she made when she was at the height of her fame and fortune. She admitted that she was a big spender and that she didn’t know how to say no to the many people who asked her for financial help. Her story is a stark reminder that even winning the lottery twice is no guarantee of a comfortable life if one lacks the discipline to manage their impulses and their bank account.

Gerald Muswagon’s Tragic End

Gerald Muswagon won a 10 million dollar jackpot in the Canadian Super 7 lottery in 1998, but his story is one of the most tragic examples of how sudden wealth can lead to a total personal collapse. He spent his winnings on a series of expensive cars for himself and his friends while also purchasing a large house that became a permanent venue for non-stop partying. He attempted to launch a logging business that failed miserably because he lacked the experience to run a company and was too distracted by his new lifestyle. The money that should have secured his future was instead used to fund a reckless cycle of excess and poor decisions.

Within a few years, the party was over and Gerald was forced to take a job doing manual labour on a friend’s farm just to make ends meet and provide for his family. The emotional weight of losing such a massive fortune and the shame of his public downfall proved to be too much for him to bear in the end. In 2005, he tragically took his own life in his parents’ garage, leaving behind a grieving family and a cautionary tale that resonates across the world. His life serves as a brutal illustration of the mental health challenges that can accompany a massive windfall when the winner is not equipped with the support system they need.

Suzanne Mullins’ Debt Trap

Suzanne Mullins won a 4.2 million dollar jackpot in Virginia in 1993 and chose to receive her winnings in annual installments rather than taking a lump sum. This seemed like a sensible decision at first because it provided a steady stream of income, but personal family tragedies and medical bills quickly began to pile up and overwhelm her finances. To cover these rising costs, she took out a massive loan using her future lottery payments as collateral, but the high interest rates and fees associated with the deal became a financial noose around her neck. She found herself in a cycle of debt that was impossible to escape despite her status as a winner.

By the time she finally won the right to receive the remainder of her prize in a lump sum, most of the money had already been promised to the lenders who had provided the initial bridge loans. She ended up being sued for hundreds of thousands of dollars that she could not pay back because the wealth had essentially vanished before she could ever truly enjoy it. Her situation highlights the predatory nature of certain financial companies that target lottery winners with complex deals that are designed to strip them of their winnings. It is a sobering lesson on the importance of reading the fine print and seeking independent legal advice before signing away one’s future for a quick fix.

Americo Lopes’ Legal Nightmare

Americo Lopes was part of a lottery pool with his coworkers in New Jersey when they hit a 38.5 million dollar jackpot in 2009, but instead of sharing the prize, he chose to keep it for himself. He quit his job claiming he needed surgery and secretly cashed in the winning ticket, hoping that his former colleagues would never find out about his incredible luck. However, the truth eventually came out and his disgruntled coworkers took him to court to claim their fair share of the winnings that they had all contributed towards. The legal battle was long and bitter, destroying the reputations and friendships of everyone involved in the dispute.

A jury eventually ordered Americo to split the prize with the other five members of the group, leaving him with a much smaller portion than he had originally tried to steal. The legal fees and the stress of the trial took a massive toll on his life, and he became a pariah in his community for his perceived greed and dishonesty. This story serves as a warning about the complications of group play and the way that money can tempt even the most hardworking people to betray those they work with every day. It reminds us that integrity is far more valuable than a pile of cash that was obtained through deception and the breaking of a mutual trust.

Ibi Roncaioli’s Secret Tragedy

Ibi Roncaioli won 5 million dollars in a Canadian lottery in 1991, but she decided to keep a significant portion of the winnings a secret from her husband, a successful doctor. She spent the money on various family members and even gave a large sum to a secret child she had from a previous relationship that her husband knew nothing about. As the money began to disappear, the tension in their household reached a breaking point because her husband could not understand where their finances were going or why his wife was acting so strangely. The secret wealth created a wall of lies that eventually led to a truly horrific and violent conclusion.

In 2003, her husband was found guilty of poisoning her to death after discovering that she had squandered the entire 5 million dollar fortune behind his back. This dark and disturbing case shows that the lack of transparency in a relationship can be exacerbated by sudden wealth to a point of no return. The money did not bring them the luxury or comfort they might have expected, but instead acted as a catalyst for a series of events that ended in murder and a life sentence in prison. It is perhaps the most extreme example of how the pressures of managing a lottery win can lead to the total destruction of a family unit and the loss of life itself.

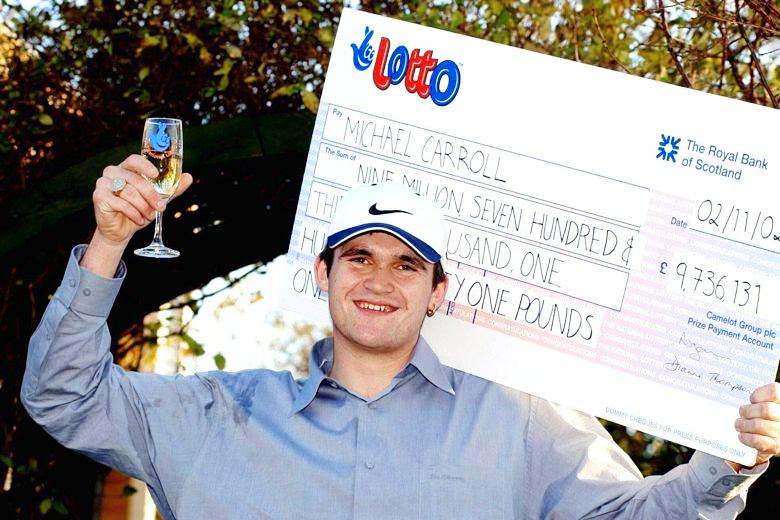

Michael Carroll’s Wasteful Reign

Michael Carroll was only nineteen years old when he won nearly 10 million pounds in the British National Lottery in 2002, and he quickly became known as the self-proclaimed King of Chavs. He spent his fortune at a breathtaking pace, purchasing a massive estate that he eventually turned into a personal demolition derby track for old cars. His life became a whirlwind of high-end parties, expensive jewelry, and a constant stream of luxury vehicles that he often crashed or gave away to acquaintances on a whim. The local press followed his every move as he transformed from a humble binman into a tabloid fixture who seemed determined to spend every penny as loudly as possible.

The thrill of the fast life eventually caught up with him as the millions began to dry up and his legal troubles started to mount. He faced numerous court appearances for anti-social behaviour and drug-related offences, which drained his remaining funds through fines and expensive legal representation. By 2010, the man who had once flaunted his wealth so aggressively was forced to declare bankruptcy and eventually found himself working in a coal yard for a modest hourly wage. Despite losing the mansion and the fame, Michael has often claimed in interviews that he is much happier now that the pressure of the money is gone and he can live a simpler life.

Sharon Tirabassi’s Vanishing Millions

Sharon Tirabassi was a single mother living on welfare in Ontario, Canada, when she won more than 10 million dollars in 2004, providing what seemed like a permanent escape from poverty. She spent her winnings with incredible generosity, buying a large house, several designer cars, and taking her friends on lavish all-expenses-paid trips to exotic locations across the globe. She also handed out large sums of money to family members and friends who were in need, believing that the fortune would last forever if she just shared the wealth with those she loved. Her heart was in the right place, but her financial planning was non-existent as she navigated her new world.

Within less than a decade, the massive bank balance had dwindled to almost nothing because she had failed to invest the money or keep track of her outgoing expenses. She eventually had to move out of her mansion and back into a rented house, returning to the workforce to support her family through a regular job. Fortunately, she had the foresight to put some of the money into trust funds for her children before it was all gone, ensuring they would have a better start than she did. Today, she views her time as a multi-millionaire as a distant dream and advocates for better financial education for those who find themselves with sudden riches.

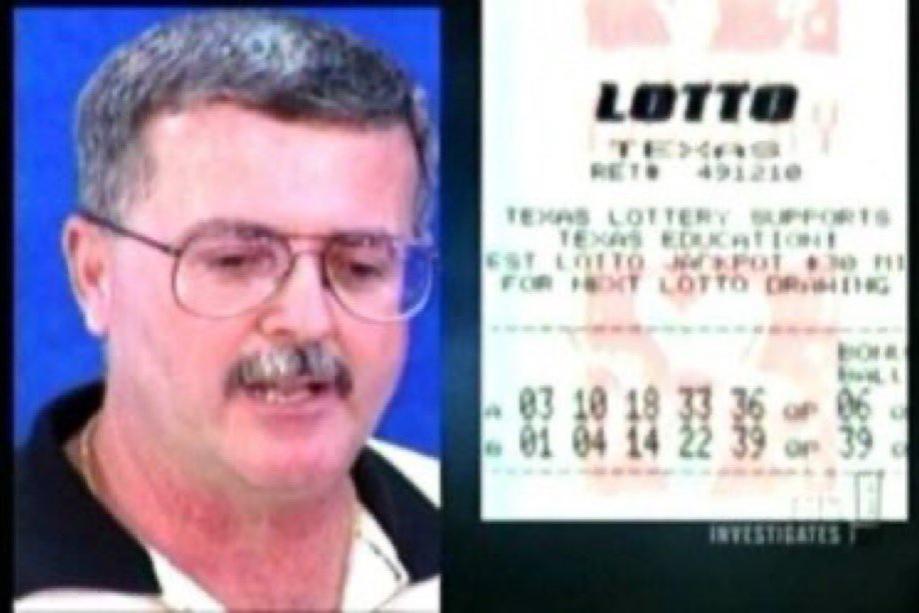

Billie Bob Harrell Jr.’s Heavy Burden

Billie Bob Harrell Jr. was a Pentecostal preacher and a shelf-stocker at a hardware store when he won 31 million dollars in the Texas Lotto in 1997. He initially used the money for noble causes, such as buying cars and homes for his family and donating a significant portion to his church to help those less fortunate. However, the constant demands for money from strangers and the loss of his privacy began to take a severe toll on his mental health and his marriage. He found that people were constantly hounding him for handouts, making it impossible for him to live the peaceful life he had envisioned for his family.

The stress of the wealth eventually became too much to bear, leading to a bitter divorce and a sense of deep isolation from the community he had tried so hard to help. Less than two years after the win that should have made his life perfect, Billie Bob tragically took his own life in his home, leaving behind a family that was shattered by the experience. Before his death, he reportedly told a financial advisor that winning the lottery was the worst thing that had ever happened to him because of the way it changed the people around him. His story remains one of the most somber reminders that a massive jackpot can sometimes carry a price that is far higher than the ticket itself.

Willie Hurt’s Downward Spiral

Willie Hurt won 3.1 million dollars in the Michigan lottery in 1989, and at the time, he appeared to be a family man with a steady job and a bright future ahead of him. However, the sudden influx of wealth acted as a catalyst for a series of personal crises that would eventually dismantle his entire life in a relatively short period. He went through a painful divorce that drained a portion of his winnings, and the emotional fallout led him into a devastating battle with addiction. The money that should have provided a safety net was instead used to fund a lifestyle that isolated him from his support system and led to increasingly poor decisions.

As his addiction deepened, Willie’s life took an even darker turn when he was involved in a tragic incident that resulted in a murder charge, forever altering his path. By the time his legal battles reached their peak, the 3.1 million dollars was completely gone, leaving him broke and facing a long prison sentence for his actions. His story is a harrowing example of how a lottery win can amplify existing vulnerabilities and lead to a total loss of character and freedom. It highlights the importance of seeking professional psychological help when dealing with the massive life changes that come with becoming an overnight millionaire in such a public way.

Alex Toth’s Desperate Days

Alex Toth won 13 million dollars in the Florida lottery in 1990, and he initially celebrated the win as a way to provide a life of luxury for himself and his wife. They spent their time traveling and staying in high-end hotels, but they soon found that the high life was incredibly expensive and difficult to maintain without a steady income. They struggled with complex tax issues and were eventually accused of tax evasion by the government, which led to a mountain of legal debt and frozen assets. The dream of a carefree retirement quickly turned into a nightmare of paperwork, court appearances, and the constant fear of losing everything they owned.

The pressure of the financial ruin was so intense that Alex passed away shortly before he was set to stand trial for his tax-related crimes, leaving his wife to face the consequences alone. At the time of his death, the couple was living in poverty and relying on a small generator for electricity because they could not afford to pay their utility bills. It was a staggering fall from grace for a man who had once held a check for millions of dollars and dreamt of a life of leisure. His experience serves as a stark warning about the necessity of hiring reputable tax professionals and accountants to manage a windfall, as the government always expects its fair share.

Denise Rossi’s Hidden Jackpot

Denise Rossi won 1.3 million dollars in the California lottery in 1996, and in a move that would ultimately lead to her downfall, she decided to keep the win a complete secret from her husband of twenty-five years. Just eleven days after she hit the jackpot, she abruptly filed for divorce without ever mentioning her newfound wealth, hoping to keep the entire sum for herself once the legal proceedings were finalised. She went to great lengths to hide the assets, even having the lottery cheques sent to her mother’s address so that her husband, Thomas, would have no inkling that their financial situation had changed so dramatically.

The secret remained buried for several years until a piece of mail from a company that handles lottery payments was accidentally sent to Thomas’s home, revealing the deception that had occurred during their split. He immediately took the matter to court, where a judge ruled that Denise had violated state asset disclosure laws by acting in bad faith and intentionally hiding the community property. In a stunning legal twist, the judge awarded the entire 1.3 million dollar prize to her ex-husband as a penalty for her dishonesty, leaving Denise with absolutely nothing but a heavy legal bill. Her story serves as a stark reminder that greed and a lack of transparency can lead to the total loss of a fortune that was meant to provide a new beginning.

Urooj Khan’s Fatal Celebration

Urooj Khan was a hardworking dry-cleaner owner in Chicago who had finally achieved the American dream when he won a 1 million dollar jackpot on a scratch-off ticket in 2012. He was overjoyed by the win and spoke publicly about how the money would allow him to pay off his debts, expand his business, and provide a comfortable life for his wife and daughter. He chose the lump sum payment, which amounted to roughly 425,000 dollars after taxes, and attended a celebratory press conference where he was photographed beaming with his ceremonial oversized cheque. It was a moment of pure triumph that should have marked the start of a prosperous new chapter for his family.

Tragically, just one day after the cheque was issued, Urooj collapsed and died before he could ever truly enjoy the fruits of his luck. While his death was initially attributed to natural causes, a suspicious relative pushed for further testing which eventually revealed that he had been fatally poisoned with cyanide. The windfall that was supposed to bring security instead brought a dark mystery that remains unsolved to this day, as his estate became the subject of a bitter legal battle between his widow and other family members. His story is perhaps the most chilling example of how sudden wealth can attract the deadliest kind of envy, turning a life-changing blessing into a permanent family tragedy.

Tonda Dickerson’s Taxing Battle

Tonda Dickerson was a waitress at a Waffle House when she was given a lottery ticket as a tip by a regular customer, and that ticket turned out to be worth 10 million dollars. Her life was immediately thrown into chaos as her coworkers sued her, claiming that they had an informal agreement to share any winnings from tickets given as tips. While she eventually won the right to keep the money in court, her troubles were far from over as the IRS came knocking for a massive gift tax payment. She had attempted to put the money into a corporation to benefit her family, but the legal structure was flawed and led to a decade-long battle with the tax authorities.

The legal fees and the eventual tax bills consumed a significant portion of her winnings, leaving her with far less than she had originally anticipated when the cameras were flashing. The stress of the litigation and the public nature of her win made it difficult for her to return to a normal life, as she was constantly viewed through the lens of her fortune. While she did not end up as broke as some others on this list, her story is a powerful example of how the legal and tax systems can strip a winner of their joy. It reminds us that even a gift can come with strings attached that are strong enough to pull a person’s life apart if they aren’t careful.

Lisa Arcand’s Failed Restaurant

Lisa Arcand won 1 million dollars in the Massachusetts lottery in 2004 and decided to use her winnings to fulfill a lifelong dream of opening her own seafood restaurant. She invested a massive portion of her prize into the business, believing that her passion for food and her new financial status would be enough to ensure its success in her local community. However, the restaurant industry is notoriously difficult to navigate, and Lisa quickly found herself overwhelmed by the high overhead costs and the daily challenges of managing a staff. She lacked the necessary business experience to keep the venture afloat when the initial excitement began to fade away.

Within just a few years, the restaurant was forced to close its doors, and Lisa was left with nothing to show for her million-dollar win except for a series of unpaid debts. She realized too late that she had put all of her eggs in one basket without a backup plan or a diversified investment strategy to protect her future. The loss of her business also meant the loss of her financial security, and she was forced to start over from scratch with a newfound appreciation for the risks of entrepreneurship. Her story serves as a cautionary tale for any winner who thinks that a passion project is a safe place to park a large sum of money without professional guidance.

Barry Shell’s Unlucky Arrest

Barry Shell won 4 million dollars in a Canadian lottery in 2009, but his moment of glory was incredibly short-lived due to a past mistake that he had hoped would stay buried. When he went to claim his prize and had his photograph taken for the official lottery announcement, the image was seen by police officers who recognized him from an outstanding warrant. Instead of heading home to celebrate his new multi-millionaire status, Barry was promptly arrested and taken into custody to face the legal consequences of his previous actions. The irony of winning the lottery only to be caught because of the publicity was a bitter pill for him to swallow.

While he still had access to his winnings, the legal troubles and the subsequent fallout from his arrest made it difficult for him to enjoy the money or build a stable future. He spent a significant portion of the prize on legal fees and bail, and his reputation was permanently tarnished by the public nature of his capture. Much like others who have lost their fortunes, the lack of a clear plan and the weight of his past led to a situation where the money eventually disappeared through poor management and a lack of focus. His experience is a unique reminder that the spotlight of a lottery win shines into every corner of a person’s life, including the parts they would rather forget.

Relying on a single stroke of luck to solve all of life’s problems is a dangerous gamble because true security is built on a foundation of character, planning, and the wisdom to know that some things are more precious than gold.

Like this story? Add your thoughts in the comments, thank you.