1. Digital wallets becoming more common than cash

What once felt stable is being reshaped by technology, policy decisions, and new expectations about life and labor. By 2026, digital wallets are expected to be more widely used than physical cash in many parts of the world. Payment platforms built into smartphones already allow users to store cards, IDs, transit passes, and even event tickets in one place. Governments and businesses continue to push cashless systems because they are easier to track, faster at checkout, and cheaper to manage than physical money. In everyday life, this means more people paying for groceries, transport, and services with taps or QR codes instead of notes and coins. Small vendors are increasingly adopting mobile payment options as smartphone access expands. While cash will not disappear entirely, its role will likely shrink, especially in urban areas, as digital payments become the default for daily transactions.

2. Salaries increasingly adjusted for location

As remote and hybrid work remain common, more employers are adjusting salaries based on where employees live rather than where company offices are located. This practice is already visible among large technology and consulting firms and is expected to expand by 2026. The idea is simple: cost of living varies widely, and companies are aligning pay with local expenses. For workers, this can mean higher purchasing power in lower-cost regions but potential pay reductions when moving away from major cities. At the same time, employers gain access to a wider talent pool without maintaining expensive offices. This shift is changing long-held assumptions about “big city pay” and is making location a more strategic career decision than ever before.

3. Side income becoming a financial necessity

By 2026, having more than one income stream is expected to feel normal rather than optional for many households. Rising living costs, unpredictable job markets, and economic uncertainty have pushed people to seek extra earnings beyond their main jobs. Freelancing, online tutoring, digital content creation, delivery services, and small e-commerce ventures are among the most common options. Social media has also normalized open conversations about side income, making it easier for people to learn from one another. While side work can provide financial relief and flexibility, it also reflects deeper concerns about wage stability. For many, extra income is no longer about luxury spending but about covering essentials, building emergency savings, and reducing dependence on a single employer.

4. Automation reshaping everyday jobs

Automation is expected to change many routine tasks by 2026 rather than completely replace entire jobs. Tools powered by artificial intelligence are increasingly handling scheduling, customer inquiries, data entry, and basic analysis. In offices, this means workers spending less time on repetitive tasks and more time on decision-making or creative work. In retail and service industries, self-service kiosks and automated systems are becoming more common. While this shift raises concerns about job security, it also creates demand for new skills related to managing, supervising, and working alongside automated systems. The biggest change for workers is adaptation: learning how to use these tools effectively may matter more than job titles themselves.

5. Financial security tied more closely to skills than degrees

By 2026, employers are expected to place even greater emphasis on practical skills rather than formal degrees alone. Short courses, certifications, and demonstrable experience are increasingly valued, especially in technology, marketing, and creative fields. This trend is driven by the fast pace of change, where traditional education can struggle to keep up with real-world demands. For workers, this means financial security depends more on continuous learning than on a single qualification earned years earlier. Many people now update their skills regularly through online platforms and employer-sponsored training. The shift is opening doors for non-traditional career paths while also putting pressure on individuals to keep learning throughout their working lives.

6. Emergency savings becoming a priority mindset

Recent global disruptions have changed how people think about financial safety, and by 2026 this mindset is expected to be firmly established. Emergency savings are increasingly viewed as essential rather than optional. Financial experts and institutions consistently recommend having several months of expenses set aside, and this advice is gaining wider acceptance. Digital banking tools now make it easier to automate small, regular savings contributions, helping people build buffers gradually. The emphasis on emergency funds reflects a broader awareness that job loss, health issues, or unexpected expenses can happen without warning. As a result, financial security is being defined less by income level alone and more by preparedness for sudden change.

7. Work benefits expanding beyond health insurance

By 2026, employee benefits are expected to extend well beyond traditional health insurance and pensions. Many employers are already offering mental health support, flexible schedules, wellness stipends, and learning allowances. These benefits are becoming key tools for attracting and retaining talent, especially among younger workers who prioritize work-life balance. Companies are recognizing that burnout and stress directly affect productivity and long-term retention. As a result, financial security is increasingly linked to overall well-being rather than salary alone. For workers, this shift means evaluating job offers based on total support systems, not just pay figures. Benefits are becoming a central part of how people measure job quality.

8. Credit access becoming more data-driven

Access to credit is expected to rely more heavily on alternative data by 2026. Beyond traditional credit scores, lenders are increasingly analyzing payment histories, income patterns, and even digital behavior to assess risk. This approach aims to include people who were previously excluded from formal credit systems, such as freelancers or those without long banking histories. While this can expand access, it also raises concerns about privacy and transparency. For consumers, understanding how financial data is used becomes more important. Credit decisions may happen faster, but they will also be shaped by a wider digital footprint, making financial habits more visible than ever before.

9. Job security defined by adaptability

Traditional ideas of job security, based on long-term employment with one company, are continuing to fade. By 2026, security is increasingly defined by adaptability and the ability to move between roles or industries. Economic shifts, technological change, and company restructuring make lifelong roles less common. Workers who can learn new skills, pivot careers, or combine experiences across fields are better positioned to stay employed. This reality is influencing how people plan their careers, focusing more on transferable skills than specific job titles. Security now comes from being employable in many contexts, not from relying on a single employer for decades.

10. Personal finance becoming more transparent

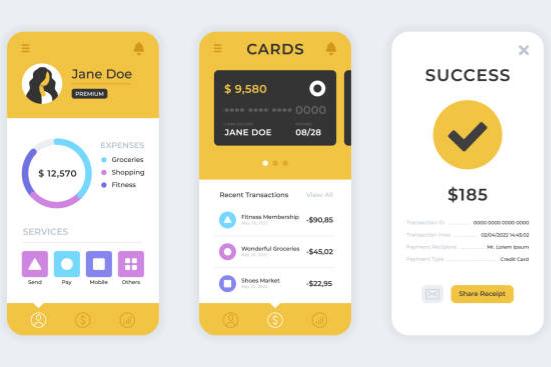

By 2026, managing money is expected to feel more transparent due to widespread use of budgeting and tracking tools. Apps now allow people to see spending patterns, subscriptions, debts, and savings in real time. This visibility helps users make quicker adjustments and avoid financial surprises. Banks and fintech companies continue to improve user-friendly dashboards that simplify complex financial data. As a result, people are becoming more informed about where their money goes and how small decisions add up. This transparency supports better planning and encourages more intentional spending. Financial awareness, once limited to spreadsheets or professionals, is becoming part of everyday life for many households.

11. Portable benefits follow gig work

Portable, pro-rated benefits for gig and contract workers are gaining traction and will be far more common by 2026. Policymakers, employer groups, and platforms are experimenting with ways to make health coverage, paid leave, and retirement contributions “follow” a worker between gigs so people who piece together income can keep basic protections. U.S. congressional discussion and white papers, plus pilot programs and private platforms, are normalizing benefit models that pool contributions across employers or that let workers carry an account across jobs. For workers this means less cliff-edge vulnerability when contracts end; for platforms and governments it means new design work to balance portability with administrative simplicity and affordability.

12. Renters get more protections and credit options

Cities and national governments have moved noticeably toward stronger renter protections and new ways to build rental credit by 2026. Laws being debated and passed in 2024–2025 improve eviction safeguards, require clearer lease terms, and in some places support rent-payment reporting to credit agencies so consistent renters can build a credit history. At the same time, expanded tenant-assistance programs and more transparent landlord-tenant rules aim to reduce housing instability. These changes won’t solve housing shortages overnight, but they will shift risk away from the most vulnerable renters and create pathways, through documented rent histories, for long-term financial access such as mortgage readiness.

13. Crypto’s messy year leads to clearer rules

After a turbulent series of exchange failures, stablecoin debates, and fraud cases, 2024–2025 produced a wave of regulatory moves that make the crypto landscape more explicit for consumers and businesses by 2026. Governments and regulators are tightening licensing for exchanges, clarifying how stablecoins are treated, and demanding better custody and disclosure practices. The result will be a market where established firms must meet clearer compliance standards, and legitimate on-ramps for consumers (and institutions) become safer and easier to evaluate. That doesn’t eliminate risk, crypto remains volatile, but the regulatory patchwork is turning into a more navigable framework that reduces a lot of the “wild west” uncertainty for everyday users.

14. Personal cyberinsurance becomes mainstream

Rising identity theft, phishing attacks, and data-breach costs have pushed consumer cyber insurance from niche to mainstream by 2026. Insurers now offer policies for individuals that cover expenses like credit-monitoring, legal help, and remediation after identity loss; demand has grown as more personal life, finances, photos, health data, lives online. Insurers and reinsurers report rapidly rising claims and are updating underwriting rules around home-office setups, password hygiene, and device security. For households, cyber insurance will act like a supplement to basic financial protection: affordable for many, and paired with stronger personal-security behavior encouraged by insurers and platforms. Expect faster claims processes, clearer policy language, and bundled offers with existing homeowners or renters plans.

15. Faster, fairer small-business lending via fintech

Fintech lenders and bank-fintech partnerships will dominate small-business lending by 2026, offering faster underwriting and more flexible products than traditional banks. Digital lenders use real-time sales, invoice, and bank data to underwrite quickly; many offer short-term, inventory, and revenue-based loans that better match seasonal cash flows. Regulators and incumbent banks are responding by tightening consumer protections while also partnering with fintechs to expand reach, especially to underserved microbusinesses. For entrepreneurs, this means quicker access to working capital, but it also requires sharper attention to terms and costs: speed has trade-offs, and informed borrowing will become an essential small-business skill.

16. Banking “super apps” bring financial services together

Super apps that bundle payments, savings, lending, insurance, and commerce into one smooth mobile experience will be considerably more common in 2026, especially outside the U.S. Markets in Asia, Africa, and Latin America are already seeing apps that combine wallets, credit, remittances, and third-party services. These platforms aim to reduce friction, users move from paying bills to buying airtime to applying for a loan without switching apps, and they’re attractive where smartphone adoption outpaces branch banking. For consumers this can mean convenience and new bundled savings, but it also concentrates data and risk in a single provider, so competition policy and data rules will be crucial to preserve choice.

17. Retirement advice becomes automated and personalised

Robo-advisors and automated wealth tools will make personalized retirement planning the default by 2026. Instead of one-size-fits-all target-date funds, many savers access automated portfolios that adapt by age, income, and stated goals; some models even use a “double glide path” that changes allocations both as people age and as wealth grows. Wider use of digital advice lowers costs and broadens access to diversified portfolios, while employers increasingly offer managed accounts as part of benefits. The shift helps workers who never received investment advice before, but it also places new importance on data privacy and on understanding fee structures and risk limitations embedded in algorithmic advice.

18. Guaranteed-income pilots push policy debate forward

By 2026, dozens of guaranteed-income experiments will have produced clearer evidence about targeted cash pilots and how they affect employment, housing stability, and health. Cities and foundations are testing recurring, unconditional payments to small groups, and the growing dataset, covering outcomes like mental health, job search behavior, and spending patterns, has pushed the conversation from abstract UBI debates to concrete policy design. Governments are more likely to scale narrow, evidence-backed programs (e.g., for caregivers, students, or displaced workers) than to implement universal payments. For citizens, this means targeted safety nets may expand, informed by measured pilots rather than ideological guesses.