1. Blockbuster Rejects Netflix (2000)

Netflix’s Reed Hastings offered to sell his small DVD-by-mail service to Blockbuster for a mere $50 million. Blockbuster’s leadership famously declined, confident that their massive physical video rental empire and late-fee model were secure, believing streaming had little future. This short-sighted refusal proved fatal. While Blockbuster, once a household name with thousands of stores, shrank to a single location in Oregon, Netflix went on to build a $150 billion streaming behemoth that utterly reshaped global entertainment. This rejection remains one of the most cited missteps in corporate history, a textbook example of how underestimating new technology can topple even the strongest brands.

2. IBM Hands Microsoft the Software Market (1980s)

When IBM introduced its personal computer, it made the fateful decision to outsource the operating system to a tiny, relatively unknown firm called Microsoft. The deal seemed minor at the time, as IBM assumed hardware sales would dominate profits. Crucially, Microsoft kept the licensing rights, meaning every PC sold by any manufacturer carried Microsoft software. This outsourcing decision catapulted Bill Gates’ company into a trillion-dollar powerhouse, and made him one of the richest men alive. IBM, meanwhile, steadily lost relevance in the personal computing era, turning a seemingly small choice into a foundational shift in the technology landscape.

3. Kodak Buries the Digital Camera (1975)

Kodak engineer Steven Sasson invented the first digital camera prototype, a revolutionary device that captured images without film. However, executives deliberately set the innovation aside, paralyzed by the worry that it would threaten Kodak’s highly profitable film business. As digital photography advanced, rivals embraced it, while Kodak stubbornly clung to film. By the time the company finally pivoted, competitors had already captured the market. Despite once being synonymous with photography, Kodak filed for bankruptcy in 2012. It remains a powerful cautionary tale about how protecting the present too aggressively can tragically destroy a company’s future.

4. Yahoo Passes on Buying Google (1998)

In its earliest days, the founders of Google offered to sell their budding search engine to Yahoo for about $1 million. Yahoo declined, overly confident in its own existing web platforms. Later, as Google’s market value began to surge, Yahoo again failed to acquire it, missing a second chance when the price was reportedly $5 billion. Google subsequently became a trillion-dollar titan of search, advertising, and data, while Yahoo steadily lost ground and faded from its early market dominance. This double missed opportunity remains one of the starkest examples of how a failure of long-term vision and short-term thinking cost a company unimaginable long-term value.

5. AOL Merges with Time Warner (2000)

Valued at a staggering $165 billion, the AOL–Time Warner merger was heralded as the dawn of a new media age, an ambitious attempt to combine old media’s content with new media’s digital reach. However, the corporate cultures immediately clashed, the dot-com bubble burst shortly after the deal closed, and billions in value evaporated. Within a few years, the entire mega-merger unraveled, and AOL faded into irrelevance. The deal, once hailed as visionary, is now remembered as the single largest corporate failure of its kind, serving as a powerful warning about hype-driven mega-mergers that lack a clear, well-thought-out integration strategy.

6. Apple Brings Back Steve Jobs (1997)

By the mid-1990s, Apple was hemorrhaging cash, its products were outdated, and the company was racing toward bankruptcy. In a desperate, bold move, Apple purchased NeXT, an acquisition that served the sole purpose of bringing back its ousted co-founder, Steve Jobs. Jobs immediately streamlined Apple’s complex product line, launched the groundbreaking iMac, and set the stage for the iPod, iPhone, and iPad. Each of these devices transformed its respective industry and fueled Apple’s incredible rebirth. From near-collapse, the decision to restore Jobs’ unique leadership became one of the most consequential corporate turnarounds in business history, creating the world’s most valuable company.

7. Disney Buys Marvel (2009)

When Disney acquired Marvel Entertainment for $4 billion, many in the industry questioned whether comic book heroes could ever justify such a price tag. The deal, however, unlocked the boundless potential of the Marvel Cinematic Universe (MCU), which went on to produce more than 20 interconnected, highly successful films. These blockbusters generated over $22 billion at the global box office. Characters like Iron Man, Captain America, and Black Panther became multi-billion-dollar brands. This acquisition transformed Marvel into a storytelling machine and fortified Disney’s position as the dominant force in entertainment, making what once seemed like a gamble a recognized masterstroke.

8. Facebook Buys Instagram (2012)

Instagram was a small startup with only 13 employees and no discernible revenue when Facebook (now Meta) acquired it for $1 billion. Many critics argued the price was wildly inflated. A decade later, Instagram boasts over two billion users, contributes tens of billions in ad revenue annually, and is a primary driver of Meta’s overall growth. The platform has become one of the most influential social networks, shaping fashion, news, and culture globally. Mark Zuckerberg’s willingness to spend heavily on a small, fast-growing rival proved to be one of the most visionary and successful acquisitions of the modern digital era.

9. Google Buys YouTube (2006)

YouTube was losing money and plagued by complex copyright issues when Google acquired it for $1.65 billion. Many observers at the time thought the price was reckless and fiscally irresponsible. Instead, YouTube grew into the dominant global video platform, with over two billion users and billions in annual revenue. It revolutionized culture, politics, and entertainment, giving rise to professional influencers and independent content creators. Today, YouTube is a cornerstone of Google’s business and one of its most valuable assets. The deal, which was once mocked as dramatically overpriced, is now celebrated as one of the most brilliant acquisitions in technology history.

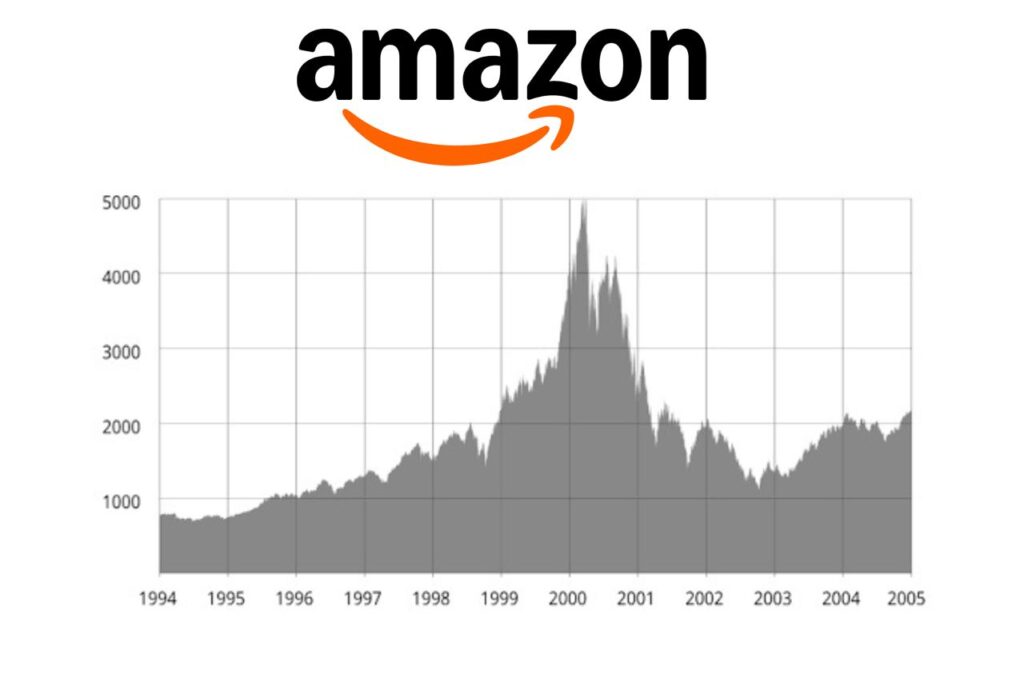

10. Amazon Survives the Dot-Com Crash (2000)

When the internet bubble burst, Amazon’s stock plummeted by more than 90%, and critics confidently labeled the company a doomed experiment. Jeff Bezos stayed the course, steadfastly reinvesting in technology, sophisticated logistics, and long-term customer growth over immediate profits. While hundreds of competitors disappeared in the crash, Amazon endured. Over the next two decades, it expanded into cloud computing (AWS), streaming, and global logistics, transforming into a trillion-dollar empire. Surviving when all others failed cemented Amazon as one of the most important companies of the modern era, proving that unwavering vision and patience can overcome market panic.

11. Microsoft Buys Nokia (2013)

Hoping to compete head-to-head with Apple and Google in the surging smartphone market, Microsoft acquired Nokia’s phone business for $7.2 billion. However, by that time, the smartphone wars were already effectively won by the two major players. Nokia’s Windows-based products failed to compete, the acquisition struggled with integration, and Microsoft ultimately wrote off nearly the entire investment. Nokia, once the indisputable global leader in mobile phones, disappeared from relevance, and Microsoft conceded defeat in the handset business. The deal is now cited as a costly lesson that even vast resources cannot revive a business if the market has already decisively moved on.

12. Quibi Burns $1.75 Billion (2020)

Backed by media veterans Jeffrey Katzenberg and Meg Whitman, Quibi promised to revolutionize entertainment with short-form, high-production shows specifically designed for mobile viewing. The company raised nearly $2 billion and launched with major celebrity talent, yet it collapsed within just six months. Audiences failed to adopt the unique platform, the content failed to resonate, and the global pandemic shifted consumer habits away from on-the-go viewing. The company returned what funds it could to investors. Quibi’s rapid rise and spectacular fall became one of the most expensive and visible failures in modern media history, demonstrating that money and pedigree cannot substitute for genuine audience connection.

13. Sears Misses E-Commerce (1990s–2000s)

Sears once commanded American retail, with vast catalogs, sophisticated logistics, and unparalleled national reach, tools that positioned it perfectly to lead the e-commerce revolution. Instead, executives dismissed the potential of the internet, focusing exclusively on defending the brick-and-mortar store model. Meanwhile, Amazon grew rapidly from a niche bookstore into the world’s largest online retailer. Sears, unable to adapt to the digital age, eventually fell into bankruptcy. Its decline from retail titan to a vanished brand is often contrasted with Amazon’s rise. Sears had all the necessary components to succeed online but lacked the fundamental vision to pivot.

14. MySpace Implodes After Selling (2005)

At its absolute peak, MySpace was the world’s largest and most dominant social network, and News Corp acquired it for $580 million. However, poor management, a cluttered and confusing design, and the arrival of Facebook’s streamlined, cleaner platform rapidly eroded its user base. By 2011, MySpace was sold again, this time for a paltry $35 million. The rapid decline from market leader to irrelevance demonstrated how quickly dominance in the technology sector can vanish. MySpace’s story is now a case study in how cultural relevance, a clean user experience, and continuous innovation matter far more than early size or initial market hype in the fast-moving digital world.

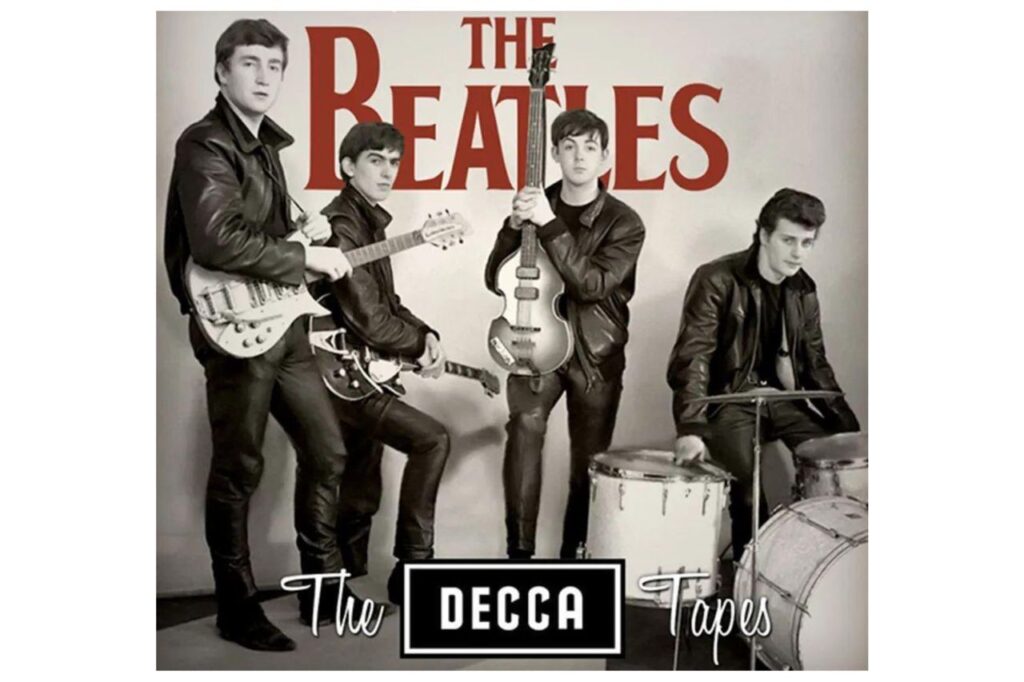

15. Decca Records Rejects The Beatles (1962)

After a test audition, Decca Records made a spectacular and infamous decision not to sign The Beatles, with an executive reportedly declaring that “guitar groups are on the way out.” EMI signed them instead, and The Beatles went on to become the best-selling band in history, generating billions in sales and cultural influence. Decca’s monumental misjudgment has become one of the most famous mistakes in music business history, a stark, painful reminder that even seasoned professionals can utterly fail to see transformative talent or a massive market shift when it is right in front of them.

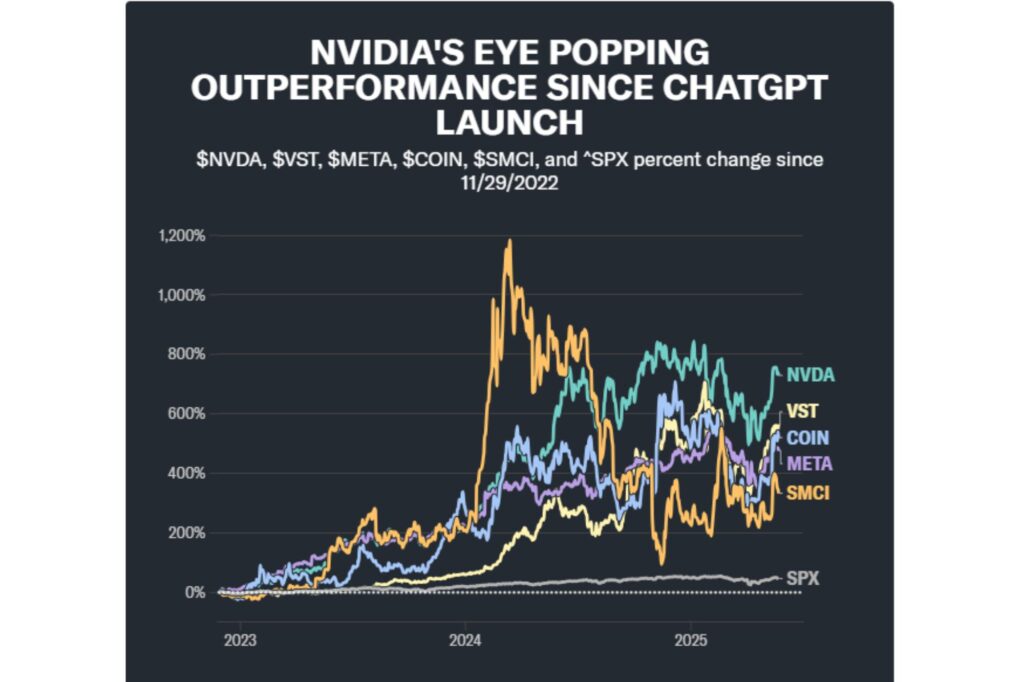

16. Nvidia Bets on AI (2010s)

Known primarily for graphics chips that powered high-end video games, Nvidia quietly and deliberately began focusing its technology on artificial intelligence (AI), machine learning, and data center computing. The strategic move seemed niche at the time, but it proved utterly transformative. Nvidia’s specialized chips became essential for training advanced AI models and powering breakthroughs in self-driving cars, sophisticated healthcare, and academic research. That visionary pivot turned Nvidia into one of the world’s most valuable companies, recently reaching a trillion-dollar market cap. Its success shows how betting early and heavily on the right foundational trend can redefine an entire industry.

17. Disney Buys Pixar (2006)

By the early 2000s, Disney’s internal animation studio was noticeably faltering, with underperforming titles threatening its core reputation. Pixar, in sharp contrast, had delivered back-to-back, critically acclaimed hits like Toy Story, Finding Nemo, and The Incredibles. Disney acquired Pixar for $7.4 billion, a deal that brought Steve Jobs onto its board and fundamentally revitalized its entire animation business. The partnership delivered a continued stream of blockbusters, from Up to Inside Out, firmly restoring Disney’s creative dominance in family entertainment. The deal was about ensuring Disney’s creative and market leadership would remain unassailable for generations to come.

18. Tesla Bets Everything on the Model S (2012)

Tesla was still a struggling upstart, burning through cash, and facing immense skepticism about the viability of electric vehicles (EVs). Elon Musk staked the company’s entire future on the Model S sedan, betting that a luxury, high-performance EV could fundamentally prove that electric cars were desirable and viable. The gamble paid off spectacularly: the Model S won industry awards, generated massive consumer demand, and reset expectations for the entire auto industry. Tesla went on to become one of the most valuable automakers in the world, successfully forcing the global industry to pivot to electric. Musk’s bold, all-in risk successfully reshaped transportation.

19. Elon Musk Bets on SpaceX (2008)

After three consecutive rocket launch failures, SpaceX was dangerously close to bankruptcy. Elon Musk invested his remaining personal fortune into one last, desperate attempt. The fourth launch succeeded, securing a crucial victory that was soon followed by lucrative NASA contracts. That singular moment saved the company and paved the way for SpaceX to become the most valuable private space company in the world. The decision was an extreme risk of everything he owned, but it established Musk as a visionary leader in aerospace and commercial spaceflight. SpaceX’s survival story is now legendary, powerfully illustrating the power of persistence under immense pressure.

20. Facebook Rejects Yahoo’s $1 Billion Offer (2006)

Yahoo attempted to acquire a young Facebook for $1 billion in 2006. Mark Zuckerberg famously turned it down, a move many industry analysts considered reckless for a startup with no guaranteed path to profitability. Over time, that bold refusal proved deeply prescient. Facebook grew into one of the world’s largest and most influential technology companies, worth hundreds of billions. Yahoo, by contrast, lost its early dominance and faded into commercial irrelevance. Zuckerberg’s decision not to sell out is now seen as one of the boldest and smartest refusals in modern business history, prioritizing long-term vision over short-term gain.

21. New Coke Backfires (1985)

Coca-Cola reformulated its flagship product to compete with the growing market success of Pepsi, launching the product as “New Coke.” The backlash from consumers was immediate and intense. Loyal customers flooded the company with complaints, desperately hoarded the old formula, and even staged public protests. Within three months, Coca-Cola was forced to reinstate the original product, rebranding it as “Coke Classic.” While the experiment was a widely acknowledged marketing disaster, it also inadvertently reinforced the profound consumer loyalty and emotional attachment to the Coke brand. The failure is remembered as a warning of the risks in altering a beloved product.

22. Apple Launches the iPhone (2007)

When Apple unveiled the iPhone, critics argued the mobile market was already saturated with established companies like Nokia, BlackBerry, and Motorola. But the iPhone’s revolutionary touchscreen, simple app ecosystem, and elegant design completely revolutionized personal communication. Within just a few years, it dismantled the older market players and created an entirely new, multi-billion-dollar economy around mobile applications. The iPhone did more than just succeed, it transformed industries from photography to finance and became the cornerstone of Apple’s trillion-dollar valuation. It remains one of the single most influential and market-shifting product launches in business history.

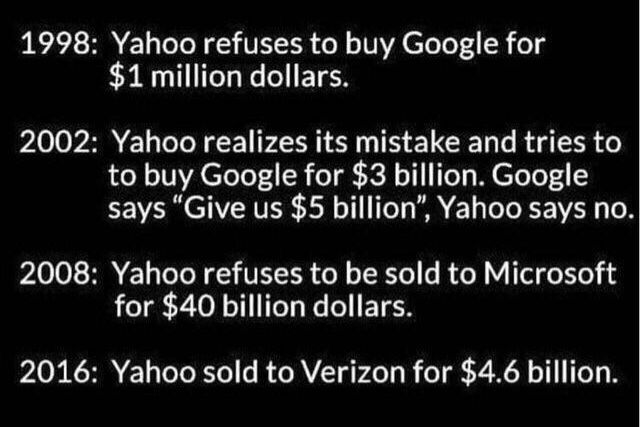

23. Yahoo Misses Buying Google and Facebook (1998 & 2006)

Yahoo had two separate, definitive chances to fundamentally change its future. In 1998, it passed on acquiring Google for $1 million. Later, in 2006, it failed to close a deal to buy Facebook for $1 billion. Both of those companies grew into trillion-dollar titans, while Yahoo steadily declined and was eventually sold for a small fraction of its peak value to Verizon. These two missed opportunities are now legendary examples of profound hesitation and critical misjudgment in tech history. Arguably, no company has turned away more potential, transformative wealth than Yahoo, making its decline a chilling case study in squandered opportunity.

24. Amazon Buys Whole Foods (2017)

Amazon’s $13.7 billion acquisition of Whole Foods market shocked the entire retail world. The deal instantly gave Amazon a nationwide network of physical stores and a major position in the grocery business, a market where margins are tight but scale is enormous. Competitors scrambled to respond, quickly launching new delivery services and cutting their prices. The acquisition was about more than just groceries, it was about Amazon embedding itself deeper into the everyday life of the American consumer. By merging its digital retail expertise with a physical store presence, Amazon set a powerful precedent for the future of shopping, further cementing its role as a cross-industry force.

The decisions that shape global commerce are rarely obvious in the moment, and the line between genius and folly is often incredibly thin. These stories remind us that in business, as in life, the willingness to embrace the new and the courage to refuse the sale are often the truest ingredients for building a lasting legacy.

Which of these decisions do you think had the biggest impact on your own daily life?

This story 24 Business Decisions That Made Billions, and Others That Wrecked Empires was first published on Daily FETCH