1. Track Daily Spending

Taking a clear look at where your money goes every day is a habit financial experts have championed for decades. Back in the 1970s, this usually meant carrying a small physical notebook to jot down every loaf of bread or gallon of gas purchased. Today, while we have sleek budgeting apps, the core mission remains exactly the same. Research conducted throughout the 2010s suggests that simply being aware of your spending habits can naturally lead to a 10% to 15% reduction in total expenses. This happens because “awareness” acts as a natural brake on the impulse to buy things we don’t actually need.

When you track your cash flow, you start to see the “invisible” leaks in your boat, like that $5 snack at the pharmacy or a small ride-share fare that seemed minor at the time. Beyond just the math, this habit gives you a genuine sense of psychological control. Many people describe a “lightbulb moment” when they realize their morning latte habit costs them over $1,200 a year. It transforms money from a source of stress into a tool you can manage with confidence. Seeing your progress in a notebook or on a screen makes your financial goals feel tangible, helping you spend with purpose rather than waking up to a mystery balance.

2. Cancel Unused Subscriptions

The “subscription economy” exploded in the mid-2010s, changing how we buy everything from movies and music to gym memberships and even razor blades. By 2022, studies showed that the average consumer was spending over $200 a month on various subscriptions, often underestimating their total cost by hundreds of dollars. Many of these services use “auto-renewal” features, which means they quietly bill your credit card while you aren’t looking. Consumer watchdogs frequently point to this “subscription creep” as one of the biggest modern threats to a healthy household budget, as small $10 fees slowly pile up into a mountain of debt.

The good news is that cutting these ties provides an instant “pay raise” without requiring you to work a single extra hour. Most people find that they don’t even miss the services once they are gone, experiencing a sense of relief rather than a feeling of sacrifice. Trimming your digital life helps you focus on the platforms you actually enjoy and use every day. Imagine your phone screen, clearing out those unused apps is like cleaning a cluttered room. It’s a quick win that puts money back in your pocket immediately, making it one of the most effective and least painful ways to lower your monthly overhead.

3. Cook More Meals

Eating out has moved from a rare luxury to a daily convenience for many, a trend that accelerated rapidly in the late 1990s as fast-casual dining took over the market. However, recent cost-of-living data confirms that cooking at home is still roughly five times cheaper than ordering from a restaurant or using a delivery app. When you factor in the delivery fees and tips that became standard in the 2020s, the savings from a home-cooked meal become even more dramatic. Even committing to cooking just three extra nights a week can save a typical household thousands of dollars over the course of a single year.

Beyond the financial perks, getting back into the kitchen allows you to reconnect with a tradition that many of us remember from childhood. There is a deep, quiet satisfaction in preparing a meal from scratch and knowing exactly what ingredients are going into your body. Families often find that the time spent chopping vegetables or simmering a sauce becomes a valuable period for conversation and bonding. It isn’t just about saving pennies; it’s about reclaiming your time and your health. Over time, home cooking stops feeling like a chore and starts feeling like a rewarding lifestyle choice that keeps your bank account and your body much healthier.

4. Use Shopping Lists

The humble shopping list has been a cornerstone of smart household management for over a century, long predating the arrival of modern smartphones. Consumer behavior studies from the early 2000s show that shoppers who stick to a list spend significantly less than those who “wing it.” This is because modern supermarkets are scientifically designed to encourage impulse buys. From the smell of rotisserie chicken to the candy bars at the checkout line, every inch of a store is meant to tempt you into spending more. A list acts as a protective shield against these professional marketing tactics, keeping you focused on what you actually need.

Walking into a store with a plan turns a potentially overwhelming experience into a simple, efficient task. You’ll likely notice that you leave the shop feeling much calmer because you aren’t second-guessing your choices at the register. Whether you prefer a handwritten note on a scrap of paper or a digital checklist on your phone, the result is the same: a lower grocery bill and less food waste at home. Over time, this small bit of discipline helps you build a more intentional relationship with your money. It ensures that your hard-earned cash is going toward nourishing your family rather than filling the pockets of clever retail advertisers.

5. Reduce Energy Usage

Energy conservation has been a major public focus since the early 2000s, as both environmental concerns and utility prices have climbed steadily. Simple actions, such as switching to LED bulbs or lowering the thermostat by just two degrees during the winter, are backed by decades of data showing they make a real dent in monthly bills. In fact, the Department of Energy suggests that these small adjustments can save the average homeowner up to 25% on their utility costs. It is one of the few ways to save money that requires almost no effort once the initial habit is established in your daily routine.

The beauty of saving energy is that it quickly becomes invisible. You don’t feel any less comfortable once you get used to turning off the lights when leaving a room or using a smart power strip to stop “vampire” energy drain from electronics. These small, consistent actions accumulate quietly in the background of your life. Eventually, you stop thinking about the switches and start simply enjoying the lower balance on your monthly statement. It is a win-win scenario where you are helping the planet while also ensuring that you have more money left over for the things that truly matter to you and your family.

6. Buy Generic Brands

Generic or “store-brand” products have come a long way since they first gained major traction in the 1980s. Back then, they were often seen as inferior, but today’s generic items are frequently manufactured in the same facilities as the big-name brands. Independent testing groups consistently find that store-brand staples—like flour, sugar, over-the-counter medicines, and cleaning supplies, are identical in quality to their flashier, more expensive counterparts. By choosing the plain packaging over the heavily advertised one, shoppers can easily save 30% or more on their weekly grocery haul without sacrificing the quality of the goods they bring home.

Making the switch to generic brands is often more about overcoming a psychological hurdle than a financial one. We are conditioned by millions of dollars in advertising to trust a specific logo, but once you try the store-brand version, you’ll often find no difference in taste or performance. This habit builds your confidence as a consumer, allowing you to see past the clever marketing and focus on the actual value of the product. Over time, these savings become second nature. You’ll find that your pantry looks much the same, but your savings account grows steadily because you are no longer paying a “brand tax” on your basic everyday necessities.

7. Limit Impulse Purchases

Impulse buying is an emotional reaction that has been studied extensively since the rise of internet shopping in the late 2000s. With “one-click” ordering and targeted social media ads, it has never been easier to spend money in a moment of boredom or stress. Financial educators often point out that these small, unplanned purchases are the primary reason people feel they “can’t save,” even when they have a decent income. By introducing a simple “waiting period” such as 24 hours for small items or 30 days for larger ones, you allow the emotional urge to fade so your logical brain can take over.

Most people find that after a day of reflection, the “must-have” item from the night before no longer seems very important. This practice isn’t about denying yourself joy; it’s about making sure your purchases are actually bringing you long-term value. It replaces the immediate “shopper’s high” with a more lasting sense of financial security and confidence. Imagine scrolling through your phone and having the strength to simply close the tab—that is a powerful feeling of self-mastery. By limiting impulse buys, you ensure that your money is being saved for meaningful goals, like a family vacation or an emergency fund, rather than being wasted on clutter you’ll eventually just throw away.

8. Use Public Transport

Since the 1990s, the cost of owning and maintaining a private vehicle has risen much faster than general inflation. When you add up fuel, insurance, parking, and the constant depreciation of the car’s value, the “freedom” of driving can become a massive financial burden. Public transport offers a tried-and-true alternative that has supported urban workers for over a century. In many cities, switching from a daily drive to a bus or train commute can save an individual over $9,000 per year. Even if you only use public transit a few days a week, the savings on gas and wear-and-tear are immediately noticeable.

Beyond the clear financial benefits, using public transport can significantly lower your daily stress levels. Instead of fighting through heavy traffic or hunting for a parking spot, you can use that time to catch up on a book, listen to a podcast, or even get a head start on your emails. It turns a frustrating part of the day into a productive or relaxing one. Seeing the world go by from a train window provides a different perspective on your community and can make the city feel much more accessible. For many households, making the switch is a path to a simpler, more affordable lifestyle that leaves more room in the budget.

9. Review Insurance Plans

Insurance is one of those “set it and forget it” expenses that can quietly drain your bank account if you aren’t careful. Many people stay with the same provider for a decade or more, unaware that rates and coverage options change every year. Since the early 2000s, the rise of online comparison tools has made it easier than ever to see if you are overpaying for your car, home, or life insurance. Consumer reports frequently show that those who take thirty minutes to shop around or negotiate with their current provider can save hundreds of dollars annually on their premiums.

While reviewing paperwork might feel like a boring chore, the financial reward is often one of the highest “hourly rates” you can earn for your time. It’s about ensuring that your current policy actually reflects your current life. For example, if you are driving less than you used to, your auto insurance should be cheaper. Successfully updating your plans provides a great sense of peace of mind, knowing you are protected without being overcharged. It turns a forgotten monthly bill into an informed, strategic decision. Regular reviews keep your expenses aligned with your actual needs, preventing your hard-earned money from disappearing into unnecessary corporate profits.

10. Set Spending Limits

Setting clear spending limits is a timeless budgeting strategy that works because it creates a “safety net” for your finances. From the old-fashioned “envelope system” used by our grandparents to the modern digital caps available on banking apps today, the goal is to give yourself a finite amount of money for “extras.” Research consistently shows that when people have a specific limit for things like dining out or clothes shopping, they are much more creative and thoughtful about how they spend. It prevents the “oops” moment at the end of the month when you realize you spent your rent money on a new hobby.

Emotionally, having a limit actually reduces the guilt associated with spending. If you know you have $100 set aside for fun, you can spend it freely without worrying about the electric bill. It replaces the constant, vague anxiety of “can I afford this?” with a clear, definitive “yes” or “no.” This clarity is essential for long-term financial health and helps keep the peace in households where multiple people are spending from the same pool of money. Over time, these boundaries don’t feel like a cage; they feel like a map that guides you toward your bigger dreams, helping you balance today’s enjoyment with tomorrow’s security.

11. Shop With Cash

Using physical cash is a classic budgeting trick that has seen a resurgence as a way to combat the “frictionless” spending of the digital age. Since the mid-1990s, when debit and credit cards became the primary way to pay, researchers have noted a phenomenon called “payment coupling.” This essentially means that when we swipe a card, our brains don’t feel the “pain” of the purchase as much as when we physically hand over twenty-dollar bills. Studies from the early 2010s found that people are willing to pay up to 50% more for items when using plastic instead of cold, hard cash.

When you use cash for your weekly groceries or “fun money,” you create a very real, physical limit. Watching your wallet get thinner provides an immediate, honest feedback loop that a banking app simply can’t match. Many people find that this habit helps them prioritize their needs over their wants without needing a complex spreadsheet. It turns every transaction into a mindful choice rather than an automatic habit. While the world is moving toward a cashless society, keeping a few envelopes of paper money for your variable expenses is a powerful way to stay grounded. It’s a simple, low-tech solution that helps you keep your monthly costs under total control.

12. Buy Secondhand Items

The market for secondhand goods has undergone a massive transformation since the launch of eBay in 1995 and Craigslist in the late ’90s. What used to be limited to dusty thrift stores and weekend garage sales is now a sophisticated global economy. Since 2015, the “re-commerce” industry has grown 20 times faster than the broader retail market. Whether you are looking for designer clothing, high-end kitchen appliances, or solid wood furniture, you can often find items in nearly new condition for 50% to 70% off the original retail price. This shift allows families to maintain a high quality of life while spending a fraction of the cost.

Beyond the obvious financial savings, buying secondhand offers a unique sense of discovery that you just won’t find at a big-box retailer. There is a special kind of “thrifting high” that comes from finding a high-quality, durable item that was built to last. Many people also appreciate the environmental benefit of keeping perfectly good items out of landfills. It encourages a more sustainable way of living that values craftsmanship over fast-fashion trends. By making “pre-loved” your first choice, you aren’t just saving pennies; you are building a home filled with character and quality. Over time, this becomes a rewarding lifestyle habit that makes your monthly budget stretch much further than you ever thought possible.

13. Plan Weekly Meals

Meal planning became a vital tool for household management in the early 2000s as food prices began to fluctuate more significantly. The concept is straightforward: by deciding what you will eat for the next seven days before you go to the store, you eliminate “panic buying” and expensive mid-week trips to the grocery shop. Data from 2023 indicates that the average household throws away nearly 30% of the food they buy. Planning your meals directly targets this waste, ensuring that every bunch of spinach or pound of ground beef you purchase actually ends up on a dinner plate rather than in the trash.

In addition to the financial boost, meal planning removes the daily “What’s for dinner?” stress that many people face after a long workday. It creates a structured routine that makes your evenings much calmer and more organized. When you have a plan, you are also much less likely to give in to the temptation of expensive delivery apps or fast-food drive-thrus. You can even save more by centering your weekly plan around what is currently on sale at your local market. It is a quiet, steady habit that builds discipline and provides a great sense of accomplishment. Over time, meal planning transforms the way you view food, turning it from a chaotic expense into a well-managed part of your successful lifestyle.

14. Avoid Brand Loyalty

Brand loyalty was a cornerstone of 20th-century marketing, with companies spending billions to make us feel an emotional connection to their logos. However, since the Great Recession of 2008, consumer habits have shifted dramatically. More people are realizing that loyalty usually only goes one way—the company gets your money, but you don’t always get the best value. Switching brands based on what is currently on sale or moving to a competitor’s product can save a typical family hundreds of dollars every month on household basics like laundry detergent, snacks, and personal care items.

Breaking free from brand loyalty is an empowering move that puts you back in the driver’s seat of your finances. Many shoppers are pleasantly surprised to find that a “lesser” brand or a store-brand alternative works just as well as the one they have used for years. It encourages you to be a more curious and flexible shopper, always looking for the best deal rather than shopping on autopilot. This habit helps you see through the “smoke and mirrors” of fancy packaging and celebrity endorsements. By prioritizing value over a name, you ensure your money is working as hard as you do. Ultimately, this flexibility allows you to maintain your standard of living while significantly reducing the amount of cash that leaves your pocket.

15. Reduce Online Shopping

The convenience of online shopping reached a fever pitch in the 2010s, with the rise of smartphone apps that make it possible to buy anything in seconds. While this is great for busy schedules, it has also led to a significant increase in “passive spending.” Studies from 2021 found that consumers are likely to spend significantly more when shopping on a mobile device because the process is so fast and detached from the reality of paying. By intentionally making it harder to shop online, such as deleting saved credit card info or removing shopping apps, you create “positive friction” that protects your bank account.

Many people find that their desire for a product drops off completely if they simply wait a few hours before hitting the “buy” button. Reducing your digital browsing time helps you break the habit of using shopping as a form of entertainment or a way to cope with stress. Instead of scrolling through endless product feeds, you can redirect that time toward hobbies that don’t cost a dime. This shift helps you regain focus on your true financial priorities, like paying off debt or saving for a down payment. By using online stores as tools for specific needs rather than places to hang out, you’ll find that your monthly credit card statement becomes much easier to manage.

16. Cut Cable Television

Cable TV subscriptions reached their peak in the United States around 2011, with millions of households paying over $100 a month for hundreds of channels they never watched. Since then, the “cord-cutting” movement has transformed the entertainment landscape. Moving away from traditional cable in favor of a few select streaming services or a digital antenna can easily save a household over $1,200 a year. This change doesn’t mean you have to miss out on your favorite shows or sports; it just means you are only paying for the content you actually enjoy.

Most people find that the transition away from cable is much smoother than they expected. Modern streaming platforms offer much more flexibility, allowing you to cancel and restart services whenever you like without long-term contracts or hidden equipment fees. This shift encourages more intentional viewing whereby you sit down to watch a specific show rather than mindlessly flipping through channels. It can also lead to more quality time spent on other activities, like reading or exercising. By cutting the cord, you are taking back control of both your wallet and your time. It’s one of the most effective ways to slash your fixed monthly costs with almost no negative impact on your daily enjoyment of life.

17. Walk Short Distances

In the mid-to-late 20th century, many towns were designed around the car, leading people to drive even for the shortest errands. However, in the 2020s, the “15-minute city” concept has gained popularity, encouraging people to walk for trips that are less than a mile. Walking isn’t just a free form of exercise; it’s a direct way to save money on gas, car maintenance, and parking fees. When you consider that the average cost of driving a car is now over 60 cents per mile, those short trips to the corner store or the post office really start to add up over a month.

Beyond the financial savings, walking offers a much-needed break from the fast pace of modern life. It gives you a chance to clear your head, breathe some fresh air, and actually see what is happening in your neighborhood. Many people report feeling more connected to their community when they walk rather than drive. It is a simple lifestyle change that requires no special equipment, just a comfortable pair of shoes. Over time, choosing to walk for local errands becomes a healthy, money-saving habit that feels like a reward rather than a sacrifice. It’s an easy way to lower your monthly expenses while also doing something great for your physical and mental well-being.

18. Use Price Comparison Tools

The way we shop changed forever in the early 2000s with the launch of price comparison websites. These tools, which have now evolved into sophisticated browser extensions and apps, allow you to see the price history of an item and compare it across dozens of retailers in seconds. Research from 2022 suggests that shoppers who use these tools save an average of 15% to 20% on major purchases like electronics and appliances. In an era where prices can change multiple times a day based on algorithms, these tools ensure you are never the person paying the highest price.

Using these tools removes the “guesswork” and anxiety from shopping for expensive items. Instead of wondering if you are getting a good deal, you can have the data to prove it. Many apps will even alert you when a price drops or find hidden coupon codes at the checkout. This habit helps you become a more empowered and patient consumer, waiting for the right moment to buy rather than rushing into a purchase. It turns shopping into a strategic game where you are the winner. By taking just a few extra seconds to check a comparison tool, you can save thousands of dollars over the course of a year, keeping your monthly budget in the black.

19. Delay Nonessential Purchases

The “30-day rule” is a piece of financial wisdom that has been passed down for generations, but it became even more important with the rise of “fast shipping” in the 2010s. The idea is simple: if you see something you want that isn’t a necessity, wait a full month before buying it. This cooling-off period allows the initial rush of excitement to fade. Most of the time, you will find that the desire to own the item disappears completely within a week. This practice is one of the most effective ways to stop the “death by a thousand cuts” that happens when small, unnecessary purchases drain your savings.

Delaying a purchase gives you the gift of perspective. It allows you to ask yourself if the item will actually improve your life or if it will just become another piece of clutter in your closet. This habit fosters a sense of discipline and self-control that carries over into all areas of your life. It is especially helpful for avoiding the “lifestyle creep” that often happens when we get a raise or a bonus. By slowing down the spending process, you ensure that your money is only going toward things that truly bring you value and joy. It’s a powerful way to protect your monthly budget and build long-term wealth without feeling like you are living a life of deprivation.

20. Review Monthly Bills

Regularly auditing your monthly bills became a necessity in the 2010s as “service-based” billing became the norm for everything from internet to trash pickup. Many companies rely on “price creep,” where they slowly raise your rates over time, hoping you won’t notice the extra $5 or $10 on your statement. By taking one hour every quarter to sit down and review every line item on your bills, you can often find mistakes, outdated charges, or “promotional” rates that have expired. Consumer advocacy groups report that the average person can save over $500 a year just by catching these small errors and calling to dispute them.

Reviewing your bills puts you back in charge of your relationship with service providers. It sends a message that you are an observant customer who values their hard-earned money. Many people find that simply calling a company and asking, “Is this the best rate you can offer me?” leads to an immediate discount. It turns a passive expense into an active negotiation. This habit also helps you stay aware of how your usage patterns might be changing, allowing you to adjust your plans accordingly. By staying on top of the details, you prevent “billing bloat” from eating away at your monthly savings. It is a simple, highly effective way to ensure your money stays exactly where it belongs in your pocket.

21. Brew Coffee at Home

The daily “coffee run” became a staple of modern life in the late 1990s as major café chains expanded into nearly every neighborhood. While grabbing a latte feels like a small indulgence, prices have climbed steadily; by 2024, the average cost of a specialty coffee reached over $5 in many cities. Financial experts often point to this as a classic example of a “micro-expense” that can quietly drain a budget. Brewing your own coffee at home is a practice that was the universal standard before the mid-90s. This remains one of the fastest ways to save over $100 every single month without giving up your caffeine fix.

Switching to home brewing allows you to turn your morning caffeine fix into a peaceful, personal ritual. You have total control over the quality of the beans and the amount of sugar or cream you use, which is often healthier and more satisfying. Many people find that investing in a decent thermos or a simple French press pays for itself within the first two weeks. It’s not about giving up coffee; it’s about enjoying it for pennies instead of dollars. Over time, this small shift in your morning routine creates a significant surplus in your bank account, proving that you don’t need a professional barista to start your day on a high note.

22. Limit Takeaway Nights

Food delivery apps saw a massive surge in popularity starting around 2014, making it possible to have almost any meal brought to your door with a few taps. However, the convenience comes with a heavy price tag in the form of service fees, delivery charges, and menu markups that can increase a bill by 30% or more. By the early 2020s, many households realized that frequent takeaways were a leading cause of monthly budget shortfalls. Setting a firm limit such as “Takeaway Fridays” only helps restore balance to your food spending while making the experience feel like a genuine reward.

When you limit delivery, you also rediscover the joy of your own kitchen and the health benefits of knowing exactly what is in your food. Many people find that by planning a “fakeaway” night where they cook a homemade version of their favorite restaurant dish and they can have just as much fun for a fraction of the cost. It turns dinner from a mindless expense into a planned event that the whole family can look forward to. This habit builds a healthy sense of discipline and helps you appreciate the value of your hard-earned money. By making takeaway an occasional treat rather than a nightly fallback, you’ll see your monthly savings grow significantly without feeling like you’re missing out.

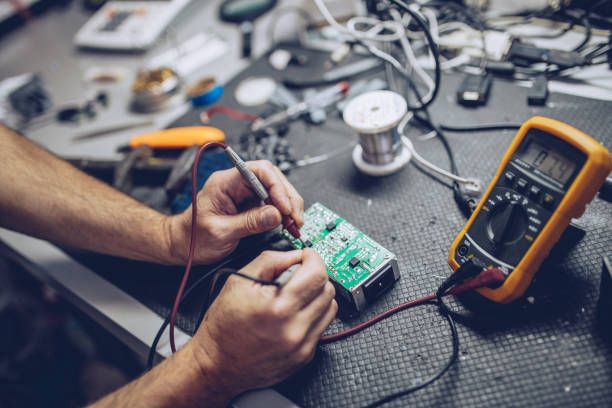

23. Repair Before Replacing

In the late 20th century, the rise of “fast fashion” and cheap electronics led to a “throwaway culture” where it was often easier to buy something new than to fix what was broken. However, since the early 2010s, the “Right to Repair” movement has gained momentum, encouraging consumers to mend their belongings instead of tossing them out. Learning basic skills, like sewing a button or replacing a cracked phone screen, can save hundreds of dollars. Repairing a high-quality pair of boots or a reliable appliance is almost always more cost-effective than buying a cheaper, lower-quality replacement that will just break again.

There is a unique sense of pride and self-reliance that comes from fixing something with your own two hands. It connects you to your possessions in a more meaningful way and reduces the constant urge to shop for the “latest and greatest.” Many communities now even host “repair cafés,” where volunteers help neighbors fix items for free, fostering a sense of social connection. This shift toward maintenance over consumption is both financially smart and environmentally friendly. By choosing to repair first, you extend the life of your items and keep more money in your pocket. It’s a return to a more practical way of living that values quality and durability over temporary convenience.

24. Share Household Costs

The concept of sharing resources has been a survival strategy for centuries, but it took on a modern form in the 2010s with the rise of the “sharing economy.” From “split-the-bill” apps to multi-user subscription plans, there are more ways than ever to divide expenses with friends, family, or roommates. Studies from 2022 show that households that share costs such as bulk-buying groceries or splitting a family streaming plan can reduce their individual monthly bills by up to 20%. It’s a practical way to enjoy high-end services and goods while only paying a portion of the total price.

Beyond the math, sharing household costs often leads to a more collaborative and social environment. Whether it’s sharing a lawnmower with a neighbor or splitting a bulk bag of rice with a friend, these interactions build community and trust. It requires a bit of communication and organization, but the financial payoff is well worth the effort. You might find that you can afford a higher standard of living by simply teaming up with others who have similar needs. This approach challenges the idea that everyone needs to own their own version of everything. By embracing a shared mindset, you can significantly lower your overhead and build stronger relationships with the people around you.

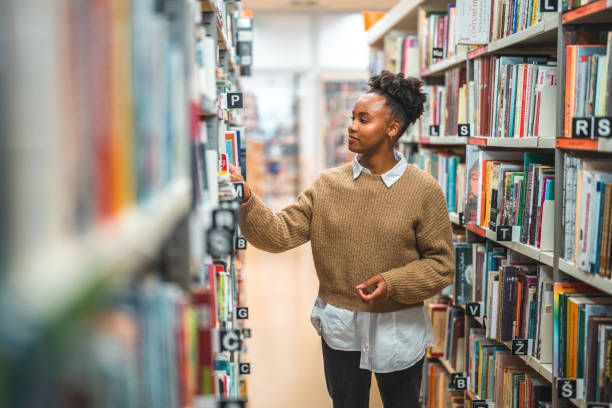

25. Use Library Services

Public libraries have been a cornerstone of local communities since the 19th century, but their value has skyrocketed in the digital age. Since the 2010s, most libraries have expanded far beyond physical books to offer free access to e-books, audiobooks, streaming movies, and even high-end creative software. Some branches even have a “Library of Things” where you can borrow tools, kitchen gadgets, or board games. Utilizing these free services can replace several monthly subscriptions, saving a typical family over $500 a year on entertainment and educational materials that they would otherwise have to buy.

Visiting the library also provides a quiet, welcoming space to work or relax without the pressure to spend money, which is a rare find in modern cities. It’s a great way to explore new interests or learn a new skill without any financial risk. Parents especially find that libraries are a goldmine for free children’s programming and resources. By making the library your first stop for books and media, you are supporting a vital public institution while keeping your own budget healthy. It is one of the most underused “hacks” for a low-cost lifestyle. Embracing your local library is a smart, simple way to enrich your life and your mind without spending a single penny.

26. Avoid Extended Warranties

Extended warranties became a major profit center for retailers in the late 1990s, often pushed heavily at the checkout for electronics and appliances. However, consumer protection groups have long warned that these “protection plans” are rarely worth the cost. Data suggests that most modern products either fail very early (which is covered by the manufacturer’s basic warranty) or last well beyond the extended coverage period. By simply saying “no” to these add-ons, you can save 10% to 20% on the total price of your purchases. Over a lifetime, these skipped warranties can add up to thousands of dollars in savings.

Instead of paying for extra insurance on every gadget, many financial experts recommend “self-insuring” by putting that same money into an emergency savings account. This way,w if something does break, you have the funds to fix or replace it, but if it doesn’t, the money stays in your pocket. This approach gives you more flexibility and prevents you from paying for “peace of mind” that you likely won’t ever need. It’s about being a confident consumer who understands the actual reliability of the products they buy. By avoiding these high-margin upsells, you keep your transactions simple and your monthly budget focused on actual needs rather than “what-if” scenarios.

27. Batch Errands Together

The habit of “batching” tasks gained popularity in the 1990s as a time-management technique, but it is also a powerful money-saving tool. Instead of making five separate trips to the store throughout the week, you plan one efficient route that covers all your needs in a single afternoon. With gas prices remaining a major concern in the 2020s, reducing the number of miles you drive is a direct way to lower your monthly transport costs. It also reduces the “hidden costs” of errands, such as the temptation to buy a snack or a drink every time you leave the house.

Batching your errands requires a small amount of planning, but it rewards you with something even more valuable than money: time. By clearing all your chores in one go, you free up your evenings and weekends for things you actually enjoy doing. You’ll find that you are more organized and less stressed because you aren’t constantly rushing out the door for a forgotten item. It also encourages you to be more intentional with your shopping, as you are working from a comprehensive list. This simple shift in how you manage your schedule creates a more streamlined life and a more predictable budget. Over time, “errand day” becomes a productive routine that saves you both fuel and mental energy.

28. Use Free Entertainment

In the late 20th century, entertainment became increasingly commercialized, leading many to believe that “having fun” always requires a ticket or a cover charge. However, the 2010s saw a renewed interest in free public spaces and community-led events. Most cities offer a wealth of free activities, from hiking trails and public parks to free museum days and outdoor concerts. By shifting your mindset to look for “no-cost” fun, you can drastically reduce your discretionary spending. It is a great way to stay social and active without the “bill anxiety” that often comes after an expensive night out.

Many people find that free entertainment is actually more fulfilling because it often involves being outdoors or connecting with the local community. A picnic in the park or a visit to a local street festival can be just as memorable as a pricey dinner or a movie. It encourages you to be more creative with your leisure time and to appreciate the beauty of your local environment. You might discover hidden gems in your own neighborhood that you never noticed while rushing to paid venues. By prioritizing free options, you ensure that your “fun money” lasts longer and that your lifestyle remains sustainable and rich in experiences rather than just expensive possessions.

29. Negotiate Service Rates

The “loyalty penalty” is a well-known concept in the service industry, where long-term customers often pay more than new ones because their initial promotional rates have expired. Since the early 2000s, savvy consumers have learned that a simple phone call can often lower their internet, phone, or insurance bills. Companies would much rather give you a small discount than lose you to a competitor. By setting aside just one afternoon a year to negotiate your rates, you can often knock $50 to $100 off your total monthly expenses. It’s one of the highest-return activities you can do for your personal finances.

While many people feel awkward about “haggling,” it’s important to remember that these companies have entire departments dedicated to “retention.” They expect these calls and often have pre-approved discounts ready to offer. Being polite but firm about your desire for a better rate is usually all it takes to see results. It turns a passive bill into an active conversation where you are in control. Successfully negotiating your rates gives you a great sense of accomplishment and keeps your monthly overhead as low as possible. It is a simple habit that ensures you are always getting the best possible deal for the services you rely on every day.

30. Pause Lifestyle Inflation

Lifestyle inflation is a common phenomenon where your spending rises at the same rate as your income. Since the 1980s, researchers have noted that even as people earn more, they often don’t feel “richer” because they immediately upgrade their cars, homes, and wardrobes. By the 2020s, the “minimalist” movement began encouraging people to consciously pause this cycle. By choosing to live on your old salary even after getting a raise, you can funnel the extra money into savings or debt repayment. This creates a massive “buffer” that provides true financial freedom and security for the future.

The key to pausing lifestyle inflation is to be content with what you already have. It’s about realizing that a brand-new car or a larger apartment won’t necessarily make you happier in the long run. When you stop the automatic cycle of upgrading, you break free from the “treadmill” of working just to pay for a more expensive life. This gives you the flexibility to take risks, like starting a business or retiring early. It is a powerful mindset shift that moves you from being a consumer to being a wealth-builder. By keeping your expenses steady while your income grows, you ensure that you are always moving toward your big-picture goals rather than just keeping up with the neighbors.