Hawaii Tops The List

The breathtaking islands of Hawaii consistently rank as the most expensive place to call home in America, and this is largely due to the fact that nearly everything must be imported from the mainland. Living in paradise comes with a premium that affects every aspect of daily life, from the astronomical price of a gallon of milk to the highest electricity rates in the entire nation. Residents often find themselves working multiple jobs just to cover the cost of a modest apartment, yet the allure of the Pacific remains a powerful draw for those who value natural beauty above financial ease. The housing market is particularly brutal because land is finite on an island chain, which means that competition for space is fierce and prices stay elevated regardless of broader economic downturns.

Beyond the obvious expenses of housing and groceries, Hawaii residents face a unique set of logistical hurdles that add to their monthly outgoings. Logistics companies charge a significant surcharge for shipping goods across the ocean, and these costs are inevitably passed down to the consumer at the checkout counter. It is also worth noting that the state has a high tax burden which further squeezes the disposable income of the average worker. While the “Aloha Spirit” provides a sense of community that many find priceless, the cold hard reality of the data shows that staying afloat in Honolulu or Maui requires a level of budgeting that would intimidate even the most disciplined accountant. Many locals have started to migrate to the mainland in search of more affordable pastures because the gap between wages and the cost of living continues to widen every year.

Massachusetts Faces High Costs

Massachusetts is frequently cited as one of the most expensive states in the country, and much of this financial pressure is concentrated in the bustling hub of Boston and its surrounding suburbs. The state is renowned for its world-class educational institutions and leading healthcare facilities, but these amenities come with a significant price tag that residents must navigate daily. Housing remains the largest hurdle for many people, as the demand for property near innovation centres and prestigious universities keeps rents and mortgages at record highs. In recent years, the cost of utilities has also spiked, particularly during the harsh New England winters when heating bills can become a major source of stress for families trying to keep their homes warm and safe.

The economic landscape of the state is bolstered by a high-performing tech and biotech sector, yet even the relatively high salaries in these industries struggle to keep pace with the rising costs of childcare and transport. Massachusetts has some of the highest nursery fees in the United States, which often forces parents to make difficult decisions about their careers and work-life balance. Furthermore, the infrastructure in older cities requires constant maintenance, leading to high local taxes that fund the public services many residents rely on. While the cultural richness and historical significance of the Commonwealth are undeniable, the financial reality of living here is a constant balancing act. It is a place where professional opportunity is abundant, but the barrier to entry for a comfortable lifestyle is significantly higher than in the vast majority of other states across the nation.

California Price Hikes Continue

California has long been synonymous with high living costs, and the Golden State continues to push the boundaries of what many people consider affordable. From the tech-heavy corridors of Silicon Valley to the sprawling suburbs of Los Angeles, the price of real estate is nothing short of legendary. This is a region where a modest bungalow can easily fetch over a million dollars, and the competition for rental properties often leads to bidding wars that exclude many young professionals. Gasoline prices in California are also consistently the highest in the country due to strict environmental regulations and high state taxes, making the daily commute a significant drain on the monthly budget for millions of workers who rely on their vehicles.

The high cost of living in California is not just limited to housing and fuel, as residents also face some of the highest state income tax rates in America. While the state offers incredible natural beauty and a Mediterranean climate that is hard to beat, the financial trade-off is becoming increasingly difficult for many to justify. In recent years, there has been a noticeable trend of people moving to neighbouring states like Nevada or Arizona to find more space for their money. Despite these departures, the demand for life in California remains strong, which keeps the prices of services and goods on an upward trajectory. The state is a land of extremes, where immense wealth sits alongside a growing affordability crisis that challenges the very idea of the California dream for the next generation of residents.

New York Expenses Rise

New York is a state of two halves, yet the immense cost of living in New York City and its affluent suburbs often defines the financial reputation of the entire region. The city remains a global financial hub that attracts talent from every corner of the earth, but the price for a slice of the Big Apple is incredibly steep. Rent in Manhattan and Brooklyn has reached levels that seem almost unfathomable to those living elsewhere, often requiring residents to share small spaces or live far from their place of work. Beyond the housing market, the cost of mundane items like a restaurant meal or a cinema ticket is significantly higher than the national average, reflecting the high overheads that businesses must pay to operate in such a dense urban environment.

Upstate New York offers some relief in terms of property prices, yet even there, the burden of property taxes is among the highest in the country. These taxes fund a robust public sector and an extensive school system, but they also represent a permanent and significant expense for homeowners. Transport costs are another major factor, with the Metropolitan Transportation Authority frequently adjusting fares and the cost of maintaining a car in the city being prohibitively expensive for many. New York is a place where the energy and opportunity are unparalleled, but it requires a very healthy income to enjoy everything the state has to offer. The constant hustle of the city is mirrored by the constant need to manage a budget that is under pressure from every possible direction, from grocery store inflation to the high cost of personal services.

Washington State Costs Grow

Washington State has seen its cost of living soar over the last decade, driven primarily by the explosive growth of the technology sector in the Seattle metropolitan area. Companies like Amazon and Microsoft have brought thousands of high-paying jobs to the region, but this influx of wealth has also pushed housing prices to levels that are increasingly out of reach for the average worker. The demand for homes has far outstripped supply, leading to a rapid gentrification of many neighbourhoods and a sharp increase in property taxes. Residents who have lived in the area for decades now find themselves struggling to keep up with the rising costs of utilities and basic services that have followed the tech boom.

While Washington does not have a state income tax, which is a major draw for high earners, it compensates for this with high sales taxes and various levies on fuel and consumer goods. This means that the day-to-day cost of living can feel quite heavy, especially when combined with the high price of groceries and healthcare. The state’s commitment to environmental protection also translates into higher costs for energy and waste management, which are passed on to households. Outside of the Seattle bubble, costs are somewhat more manageable, but the influence of the urban core is felt throughout the state as people move further out in search of affordability. Washington offers a stunning natural environment and a vibrant cultural scene, but the financial entry point for a comfortable life is now among the highest in the country, making it a challenging place for many families to settle.

Maryland Prices Stay High

Maryland is a state that benefits from its proximity to the nation’s capital, but this geographical advantage comes with a very high price tag for its residents. The suburbs surrounding Washington D.C. are home to many government contractors and federal employees, and this concentrated wealth has driven up the cost of housing and services across the region. Areas like Bethesda and Chevy Chase are consistently ranked among the most expensive places to live in the United States, with real estate prices that reflect their status as highly desirable communities. Even in more industrial areas like Baltimore, the cost of living remains stubbornly high compared to the national average, particularly when it comes to utilities and insurance premiums.

One of the most significant financial burdens for Marylanders is the combination of state and local income taxes, which can take a substantial bite out of a family’s take-home pay. Additionally, the cost of commuting in the heavily congested D.C. metro area adds both a financial and a time-based cost to daily life. Public transport is available, but many residents still rely on cars, facing high tolls and expensive parking fees. Healthcare in Maryland is also noted for being quite costly, despite the presence of world-renowned medical institutions. The state offers a high quality of life with excellent schools and plenty of historical charm, but the reality for many is a constant struggle to balance a high-cost lifestyle with the need to save for the future. It is a place where the convenience of being near the centre of power is a luxury that requires a significant financial commitment.

New Jersey Living Costs

New Jersey often finds itself in the shadow of its neighbour, New York, but it holds its own when it comes to the high cost of living. The state is the most densely populated in the country, and this density creates a high demand for housing that keeps prices elevated in almost every county. Many residents choose New Jersey for its excellent public schools and suburban lifestyle, but they pay for it through some of the highest property taxes in the nation. These taxes are a major talking point in local politics because they represent a significant portion of a household’s annual expenditure, often exceeding the cost of the mortgage itself for long-time homeowners.

The cost of groceries and transport in New Jersey is also well above the national average, partly due to the complex logistics of moving goods through such a crowded state. For those who commute into New York City, the cost of train tickets or bridge tolls can add thousands of pounds to their annual expenses. Despite these high costs, the state remains popular because of its diverse economy and its proximity to major cultural and financial centres. However, the financial pressure is leading many residents, particularly retirees, to look for more affordable options in the southern states. New Jersey offers a unique blend of coastal beauty and urban convenience, but it is a place where every aspect of life seems to come with an additional fee or a higher-than-expected price tag, making it one of the most fiscally demanding states in the union.

Connecticut Wealth And Expense

Connecticut is a state known for its affluent coastal towns and its deep connection to the financial services industry, but this reputation for wealth masks a very real cost of living crisis for many of its residents. The “Gold Coast” area, which includes towns like Greenwich and Darien, features some of the most expensive real estate in the world, and this high-end market exerts upward pressure on prices throughout the state. Housing is the primary driver of expense here, but it is closely followed by utilities, which are among the most expensive in the continental United States. The state’s ageing infrastructure and the challenges of delivering energy in a densely populated region contribute to these high monthly bills.

Beyond the cost of keeping a roof over one’s head, Connecticut residents face a high overall tax burden that includes state income tax and significant local property taxes. While the state provides high-quality public services and some of the best-performing schools in the country, the price of entry is steep. Many families find that a six-figure income does not go nearly as far as they expected, especially when childcare and healthcare costs are factored into the equation. There has been a trend of businesses and residents relocating to more tax-friendly states, which has created a complex economic situation for the state government. Connecticut remains a beautiful and historically rich place to live, but the financial reality of maintaining a household there requires a level of income that is increasingly difficult for the average person to achieve in today’s economic climate.

Oregon Becomes Less Affordable

Oregon was once seen as a more affordable alternative to its neighbours in the south, but those days are firmly in the past as the cost of living has surged across the state. Portland, in particular, has seen a dramatic increase in housing costs as it has become a popular destination for young professionals and tech workers. This influx of new residents has led to a shortage of available homes, driving up both purchase prices and monthly rents. The state’s strict land-use laws, designed to prevent urban sprawl and protect the natural environment, have also played a role in limiting new construction and keeping prices high. Residents who used to enjoy a relatively low-cost lifestyle are now finding themselves squeezed by the rising price of everything from groceries to entertainment.

While Oregon does not have a sales tax, which provides some relief at the checkout counter, it has one of the highest state income tax rates in the country. This means that while you might pay less for a new pair of shoes, your monthly paycheck is significantly smaller than it would be elsewhere. The cost of energy and transport is also on the rise, as the state moves toward more sustainable but often more expensive power sources. The natural beauty of the Pacific Northwest is a major draw, with mountains and coastline just a short drive away, but the financial burden of living in Oregon is becoming a serious concern for many. It is a state that offers a high quality of life for those who can afford it, but for many others, the dream of a quiet life in the woods is being replaced by the reality of a very expensive urban existence.

Vermont Price Increases Noted

Vermont is often pictured as a rural idyll of rolling hills and maple syrup, but the reality of living in the Green Mountain State is surprisingly expensive. One of the main factors contributing to the high cost of living is the price of housing, which has been driven up by a combination of limited supply and a high demand for second homes. Many people from larger cities like Boston and New York have purchased property in Vermont, which has pushed prices out of reach for many local residents. Additionally, the state has a very high tax burden, including significant property taxes that fund its small but high-quality school systems. This creates a situation where even those with modest homes face large annual tax bills.

The cost of basic necessities in Vermont is also higher than one might expect, largely due to the state’s rural nature and the logistical challenges of transporting goods. Groceries and household items often cost more because they have to be trucked into remote areas, and the lack of large-scale competition keeps prices elevated. Heating is another major expense, as Vermont’s long and cold winters require residents to spend a significant amount on fuel oil or electricity. While the state offers a peaceful and community-oriented way of life, it requires a robust budget to navigate the high costs of daily existence. Many young people are finding it difficult to stay in the state because the wages in local industries often do not keep pace with the rising cost of living, leading to a demographic shift that the state is currently trying to address through various economic initiatives.

Alaska Remoteness Adds Costs

Alaska presents a unique financial challenge that is largely defined by its geographical isolation and the extreme environmental conditions that residents must navigate. While the state does not impose a personal income tax and actually provides residents with an annual dividend from its oil wealth, these perks are often offset by the staggering cost of basic goods. Because so much of the food and fuel must be transported over vast distances via sea or air, the price of groceries in cities like Anchorage and Fairbanks can be significantly higher than on the mainland. This “pioneer premium” extends to almost every consumer product, making a simple trip to the supermarket a major budgetary event for families who are already dealing with high heating costs during the long, dark winters.

Beyond the supermarket aisles, the cost of healthcare and transport in the Last Frontier remains among the highest in the country due to the limited number of providers and the sheer difficulty of reaching remote communities. Maintaining a vehicle in sub-zero temperatures requires additional investment in engine block heaters and specialized tyres, while the lack of a traditional road network in many areas makes air travel a necessity rather than a luxury. Housing also remains expensive in urban hubs because the building season is short and the cost of importing construction materials is prohibitively high. Living in Alaska is an adventure that offers unparalleled access to wilderness, but it requires a hardy financial constitution to manage the logistical expenses that come with living at the edge of the world.

New Hampshire Housing Shortage

New Hampshire has traditionally been viewed as a tax haven within New England because it lacks both a general sales tax and a state income tax on wages, yet this reputation belies a growing affordability crisis. The state has seen a significant influx of new residents seeking a higher quality of life, which has led to a severe housing shortage that has pushed property prices and rental rates to record levels. Without a massive increase in new construction, competition for the limited number of available homes remains fierce, often pricing out the very workers who sustain the local economy. This lack of inventory is the primary driver of the state’s high cost of living, as families are forced to allocate a much larger portion of their income toward housing than in previous decades.

While the absence of certain taxes is a benefit, New Hampshire relies heavily on local property taxes to fund its public services and schools, resulting in some of the highest tax bills for homeowners in the United States. These annual payments can be a shock to those moving from states with different tax structures, and they represent a fixed cost that continues to rise alongside property values. Furthermore, the cost of energy in the Granite State is notoriously high, particularly for electricity and heating oil, which can lead to substantial monthly outgoings during the winter months. New Hampshire offers a wonderful blend of mountain scenery and coastal access, but the financial reality is that the “tax-free” lifestyle requires a significant upfront investment in a housing market that shows no signs of cooling down anytime soon.

Rhode Island Utility Pressures

Rhode Island might be the smallest state in the union, but the financial pressures facing its residents are anything but small, particularly when it comes to the cost of housing and utilities. The Ocean State has a high population density which keeps the demand for real estate consistently strong, especially in historic coastal towns and the revitalized areas of Providence. Renters and homeowners alike find that a significant portion of their monthly budget is swallowed up by housing costs that outpace the local wage growth. This is further compounded by some of the highest utility rates in the country, as the state’s energy infrastructure is undergoing expensive transitions and maintenance that are directly reflected in the monthly bills sent to households across the region.

The cost of living in Rhode Island is also influenced by its proximity to larger economic hubs like Boston, which draws high earners into the state and keeps prices for services and dining competitive. While the state offers a rich maritime history and a vibrant culinary scene, the everyday expenses such as healthcare and transport are noticeably higher than the national average. Local taxes can also be a burden, as the state maintains a complex system of property and vehicle taxes to fund its public works. For many residents, the charm of living in a small, tight-knit community is balanced against the reality of a budget that feels constantly stretched by the rising costs of basic necessities. It is a place where the quality of life is high, but the price of maintaining that standard is a frequent topic of conversation among local families.

Maine Grocery Prices Climb

Maine is celebrated for its rugged coastline and vast forests, but the cost of living in the Pine Tree State has become a growing concern for both locals and newcomers. One of the most noticeable areas of inflation has been in the grocery sector, where the price of fresh produce and staples is often higher than in neighbouring states due to the logistical challenges of distribution. As you move further north into more rural areas, these costs tend to rise even more, making it difficult for those on fixed incomes to keep up with their weekly shopping. The state’s economy is heavily reliant on seasonal tourism, which can also lead to price hikes in local services and amenities during the peak summer months when the population swells with visitors.

Housing in Maine has also seen a dramatic shift, with a surge in interest for second homes and remote work locations driving up prices in once-affordable coastal and mountain towns. This trend has made it increasingly difficult for local workers in the fishing and timber industries to find housing near their jobs, leading to longer commutes and higher fuel expenses. Additionally, Maine has a relatively high tax burden, including state income tax and property taxes that are essential for maintaining infrastructure in a state with such a low population density. While the pace of life in Maine is often slower and more reflective, the financial demands are quite modern and rigorous. It is a state that offers an incredible escape into nature, but it requires careful financial planning to navigate the rising costs of living in such a beautiful yet demanding environment.

Arizona Real Estate Surge

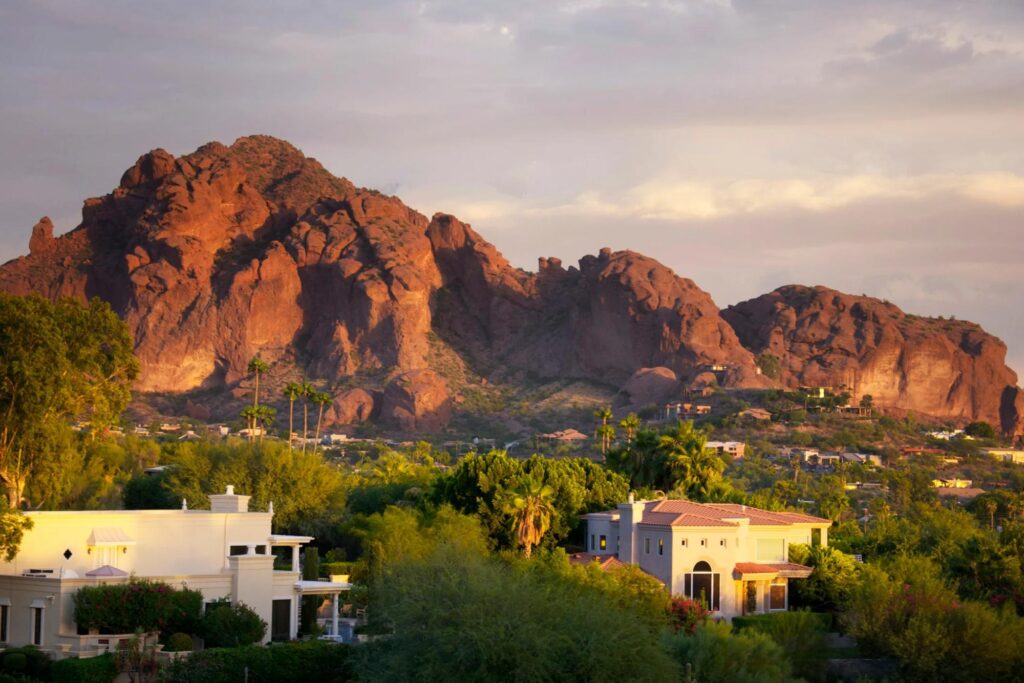

Arizona has experienced one of the most rapid increases in the cost of living in recent years, largely driven by a massive influx of people moving from even more expensive states like California and Washington. This surge in population has caused the real estate market in cities like Phoenix and Scottsdale to explode, with home values and rental prices reaching levels that were unimaginable a decade ago. The demand for housing has far outpaced new construction, leading to a competitive environment where affordable options are becoming increasingly rare. This shift has transformed Arizona from a relatively low-cost desert retreat into a bustling metropolitan region where the cost of living is now firmly above the national average in several key categories.

In addition to housing, the cost of utilities in Arizona can be a major factor, especially during the long summer months when air conditioning is a non-negotiable necessity for survival. The energy bills for a standard family home can skyrocket during the peak of heatwaves, representing a significant seasonal spike in household expenses. While the state still offers some advantages, such as lower property taxes compared to the Northeast, the rising price of groceries, healthcare, and transport is narrowing the gap. The rapid urban sprawl has also led to longer commute times and increased spending on fuel and vehicle maintenance. Arizona remains a land of opportunity with a booming job market, but the era of cheap desert living is largely over, replaced by a new reality where residents must budget carefully to enjoy the sunny climate and vibrant lifestyle.

Utah Infrastructure Demands

Utah has become a major destination for tech companies and outdoor enthusiasts alike, leading to a robust economy but also a significant increase in the general cost of living. The “Silicon Slopes” area between Salt Lake City and Provo has seen a massive investment in infrastructure, which has brought high-paying jobs but has also driven up the price of land and housing. Families who have lived in the state for generations are finding themselves competing with high-earning transplants for a limited supply of suburban homes. This pressure on the housing market is the primary contributor to Utah’s rising expenses, as the state struggles to build enough units to keep up with its status as one of the fastest-growing regions in the country.

While Utah benefits from a relatively low state income tax and a young, productive workforce, the hidden costs of living are becoming more apparent. Transport expenses are high due to the sprawling nature of the Salt Lake Valley, and the cost of childcare is a significant burden for the state’s many large families. Additionally, as the population grows, the demand for water and energy in a desert climate is leading to higher utility rates and more expensive public works projects funded by local taxes. The natural beauty of the state’s national parks and ski resorts is a major draw, but the price of living near these amenities is climbing every year. Utah is a state in transition, balancing its traditional values of thrift and community with the inescapable economic pressures of being a modern, high-growth technology hub.

Florida Insurance And Housing

Florida was long considered a premier destination for retirees looking to stretch their pensions, but a recent perfect storm of economic factors has made the Sunshine State considerably more expensive. The primary driver of this change is a crisis in the property insurance market, where frequent storms and rising litigation costs have caused premiums to triple or quadruple for many homeowners. In some coastal areas, the cost of insurance now rivals the cost of the mortgage itself, creating a massive financial burden that is forcing some long-term residents to reconsider their future in the state. This insurance spike is coupled with a housing market that saw some of the highest appreciation rates in the country during the mid-2020s, making it difficult for service workers to live near the tourist hubs they support.

Beyond the housing and insurance woes, Florida residents are also feeling the pinch at the grocery store and the petrol pump, as the state’s logistical networks are under pressure from a growing population. While Florida famously has no state income tax, it relies heavily on sales taxes and various fees which can add up quickly for the average consumer. The cost of healthcare is another concern, particularly for the state’s large elderly population who are seeing the price of supplemental insurance and out-of-pocket costs rise. The allure of white sandy beaches and year-round sunshine remains as strong as ever, but the financial landscape of Florida is now much more complex and demanding than it was just a few years ago. It is a state where the “cost of paradise” is being recalculated in real-time by millions of residents.

Colorado Wildfire Risk Costs

Colorado is a state that offers an unparalleled outdoor lifestyle, but the financial cost of living amongst the Rocky Mountains has reached new heights. In recent years, the threat of wildfires has become a permanent fixture of life, leading to a significant increase in home insurance premiums as providers re-evaluate the risk of covering properties in high-threat areas. Much like Florida, some Colorado residents are finding it difficult to secure affordable coverage at all, which adds a layer of financial insecurity to the already high cost of homeownership. The housing market in cities like Denver and Boulder remains incredibly tight, with high demand from those seeking a balance of urban amenities and mountain access keeping prices well above the national average.

The cost of living in Colorado is also influenced by the high price of transport and services in a mountainous terrain where logistics can be more challenging. While the state has a relatively flat income tax rate, the local taxes and fees associated with tourism and environmental protection can be quite high. Groceries and dining out in the popular mountain towns carry a significant premium, reflecting the high overheads for businesses operating in these remote but desirable locations. Additionally, the cost of healthcare in Colorado is a mixed bag, with high-quality facilities available but at prices that can be a shock to those coming from more rural states. Colorado is a place of immense beauty and professional opportunity, but it is also a state where the cost of living is increasingly shaped by the environmental and economic realities of the 21st century.

Idaho Rapid Growth Pains

Idaho was once one of the best-kept secrets for those seeking an affordable, high-quality life in the American West, but the secret is well and truly out, leading to some of the most dramatic growth pains in the country. The Boise metropolitan area has consistently ranked as one of the most overvalued housing markets, with a flood of new residents driving up prices far beyond what local wages can comfortably support. This rapid gentrification has transformed the state’s economic profile, making it much more expensive for the average family to find a home. Many locals who have lived in Idaho for generations now find themselves priced out of their own communities, a trend that has caused significant social and economic friction across the state.

Despite the rise in housing costs, Idaho still maintains a relatively low cost of living in other categories like utilities and groceries, though even these are beginning to creep up as the population expands. The state’s infrastructure is under immense pressure to keep up with the new arrivals, leading to debates over tax increases and bond measures to fund new schools and roads. For those moving from coastal cities, Idaho still feels like a bargain, but for the local workforce, the gap between the cost of living and the average salary is a growing chasm. The state offers a stunning landscape of rivers and mountains, but the financial entry point for a comfortable life is now much higher than it was just five years ago. Idaho is a vivid example of how quickly a state’s affordability can vanish when it becomes the latest “must-move” destination.

Nevada Tourism And Taxes

Nevada’s cost of living is heavily influenced by the twin pillars of its economy: tourism and the absence of a state income tax. This tax structure makes it an attractive destination for high earners and retirees, but the state compensates for the lack of income tax with high sales and gaming taxes that affect the daily cost of goods and services. In the Las Vegas Valley, where the majority of the population resides, the cost of housing has fluctuated significantly, currently remaining at a level that is challenging for many hospitality workers who are the backbone of the local economy. The demand for housing is driven both by local growth and by investors who see the region as a long-term growth prospect, keeping rents and purchase prices on an upward trend.

The cost of living in Nevada also reflects the challenges of living in a desert environment, particularly when it comes to the price of water and energy. As the region faces long-term drought conditions, the cost of maintaining a household with traditional desert landscaping or a swimming pool is becoming more expensive due to rising water rates and conservation fees. Additionally, the price of groceries and healthcare in Nevada is slightly above the national average, partly due to the state’s remote location in the Great Basin. While the bright lights of the Las Vegas Strip offer a unique form of entertainment, the everyday reality for Nevaders is a constant effort to manage a budget in a state where the cost of living is rising alongside its reputation as a global destination. It is a place of contrast, where the promise of a tax-free life is balanced against the practical expenses of living in a high-demand desert metropolis.

Delaware Tax Haven Appeal

Delaware is famously known as a tax haven due to its lack of a state sales tax, but this perk does not necessarily mean that life in the First State is inexpensive for the average household. The state’s strategic location in the Mid-Atlantic corridor makes it a highly attractive place for professionals working in Philadelphia or Baltimore, and this convenience has steadily driven up the cost of housing in northern counties like New Castle. Many residents find that while they save money at the till, they are paying a significant portion of their income toward property taxes and rental costs that reflect the state’s popularity. The financial services industry is a massive presence here, and the high salaries associated with it have created a competitive market for services and real estate that keeps prices consistently above the national average.

The cost of healthcare and transport in Delaware also contributes to its ranking as one of the more expensive states in which to settle. Residents often face high premiums for insurance and medical services, partly because the state’s small size leads to less competition among providers than in larger neighbouring regions. Public transport options are limited outside of the main urban hubs, which means that most families require multiple vehicles to navigate daily life, incurring high costs for fuel and maintenance. While the lack of sales tax remains a significant draw for shoppers from across the border, the overall economic reality for those living in Delaware is one of rising costs that require a steady and substantial income to manage effectively. It is a place where the fiscal benefits of the corporate laws are balanced against the high price of maintaining a comfortable suburban existence.

Virginia Professional Hub Costs

Virginia is a state of vast economic contrasts, but the high cost of living in Northern Virginia frequently dictates the state’s overall financial reputation. The region surrounding the nation’s capital is home to one of the most concentrated populations of federal employees and government contractors in the world, which has led to a real estate market that is notoriously expensive. In places like Arlington and Alexandria, the price of a modest flat can be staggering, and the competition for space is so intense that bidding wars have become the norm rather than the exception. This wealth has also influenced the price of everyday services, from high-end dining to private childcare, making it a challenging environment for those who are not working in high-paying professional sectors.

Outside of the northern bubble, Virginia still faces rising costs in areas like Richmond and the coastal Virginia Beach region, where the cost of utilities and transport is on a steady upward trajectory. The state has a progressive income tax system that can be quite heavy for mid-to-high earners, and local property taxes are a significant annual expense for homeowners. Furthermore, the cost of higher education in Virginia is among the highest in the country, adding a long-term financial burden to families planning for their children’s future. While the state offers incredible historical sites and a diverse landscape ranging from the Blue Ridge Mountains to the Atlantic coast, the financial reality is that living in the Old Dominion requires a level of fiscal discipline that is becoming increasingly necessary as prices for housing and healthcare continue to climb.

Pennsylvania Urban Price Rises

Pennsylvania has long been considered a more affordable alternative to its neighbours in New York and New Jersey, yet the cost of living in the Keystone State is rising as urban centres like Philadelphia and Pittsburgh undergo significant revitalization. This growth has led to a sharp increase in property values and rental rates, particularly in trendy neighbourhoods where demand for housing far exceeds the available supply. Young professionals and remote workers are flocking to these cities for their cultural amenities and historical charm, but this influx is inevitably pushing up the price of groceries, entertainment, and local services. Residents who once enjoyed a low-cost lifestyle are now finding that their monthly budgets are being squeezed by the same inflationary pressures seen in much larger metropolitan areas.

One of the most significant financial hurdles in Pennsylvania is the state’s unique tax structure, which includes a flat state income tax and numerous local taxes that can vary wildly from one municipality to another. These local taxes often fund essential services and schools, but they can be a shock to those moving from states with a more centralized tax system. Additionally, the cost of maintaining the state’s extensive and ageing infrastructure leads to high tolls on major motorways and expensive utility rates for heating and electricity. While rural parts of the state remain relatively affordable, the overall trend is toward higher costs, particularly as the healthcare and education sectors continue to expand. Pennsylvania remains a cornerstone of American industry and history, but the cost of participating in its modern economy is becoming a more significant factor for families across the Commonwealth.

Illinois Tax Burden Challenges

Illinois is a state that offers a high quality of life with world-class amenities, but it is also a place where the cost of living is heavily influenced by a high overall tax burden. The Chicago metropolitan area is the primary driver of the state’s economy, and while housing there remains more affordable than in coastal cities like New York or San Francisco, the property taxes are some of the highest in the nation. These taxes are a constant source of frustration for homeowners and a major factor in the high cost of renting, as landlords inevitably pass these expenses on to their tenants. For many families, the annual tax bill can be a significant portion of their total expenditure, making it difficult to save for other long-term financial goals.

Beyond the tax situation, the cost of utilities and transport in Illinois is also a concern, particularly during the harsh Midwestern winters when heating bills can spike dramatically. The state’s commitment to maintaining a massive transit system and a complex network of motorways requires significant funding, which is often reflected in high fuel taxes and tolls. Groceries and healthcare costs in the state are generally in line with the national average, but the “hidden costs” of living in a state with significant fiscal challenges can add up quickly. While Illinois provides incredible opportunities in finance, tech, and manufacturing, the financial trade-off involves navigating a complex and often expensive public sector. It is a state where the cultural richness and economic potential are balanced against a fiscal reality that requires careful planning and a robust household income to manage.

Montana Remote Luxury Shift

Montana has traditionally been a state defined by its rugged independence and affordable rural living, but a recent shift toward “remote luxury” has fundamentally altered its economic landscape. The influx of wealthy individuals seeking the peace and beauty of the Rocky Mountains has led to an explosion in real estate prices, particularly in towns like Bozeman and Missoula. This “Zoom town” phenomenon has priced many local workers out of the housing market, as modest homes are snapped up by buyers from more expensive states who are willing to pay a premium for a piece of the Big Sky Country. This rapid appreciation has transformed the state into one of the most expensive mountain regions in the country, creating a significant challenge for those who have lived there for generations.

While Montana does not have a state sales tax, which is a major benefit for consumers, it relies on property taxes and a progressive income tax to fund its state services. The cost of basic goods and services in Montana is also higher than one might expect, largely due to the vast distances involved in transporting products to remote communities. High fuel costs and the need for specialized vehicles to handle the state’s challenging terrain and heavy snowfall add another layer of expense to the monthly budget. Additionally, the cost of healthcare in rural areas can be quite high due to the limited number of facilities and the distances residents must travel for specialized care. Montana remains a paradise for those who love the outdoors, but the cost of entry has risen dramatically, making it a state where the price of solitude is higher than ever before.

South Dakota Tax-Free Squeeze

South Dakota is often lauded for its business-friendly environment and the absence of a state income tax, but this fiscal freedom does not protect its residents from the rising costs associated with a growing population. The state has seen a significant increase in demand for housing as people from across the country move to cities like Sioux Falls and Rapid City in search of a better work-life balance. This demand has pushed property prices upward, and while they remain lower than in the coastal states, the rate of increase has been a shock to local residents whose wages have not always kept pace. The lack of an income tax means the state relies heavily on sales and property taxes, which can be a significant burden for low-to-middle-income families.

The cost of living in South Dakota is also influenced by its agricultural roots and the logistical challenges of its rural geography. While some food items are relatively affordable, the cost of imported goods and specialized services can be higher due to the lack of local competition and high transport costs. Utilities can also be a major expense, particularly during the extreme winters when heating is a critical necessity. Furthermore, as the state continues to attract new businesses and residents, the pressure on its infrastructure is leading to increased local spending and higher fees for public services. South Dakota offers a unique blend of prairie beauty and economic opportunity, but the financial reality of living there is becoming more complex as the state transitions from a quiet agricultural hub to a more diverse and high-demand modern economy.

North Dakota Energy Boom Costs

North Dakota’s economy and cost of living have been tied to the energy sector for decades, and the state continues to experience the financial fluctuations that come with being a major oil and gas producer. The Bakken formation boom brought thousands of workers to the state, and while this led to a massive increase in wealth, it also caused housing prices in once-quiet towns like Williston to skyrocket. Even as the boom has stabilized, the cost of living remains high compared to other Midwestern states, as the infrastructure and services needed to support the energy industry maintain a permanent upward pressure on prices. Families in North Dakota often find that while salaries are high, the cost of maintaining a household in a remote, high-demand area is equally significant.

Beyond the housing market, North Dakota residents face some of the highest healthcare costs in the region, partly due to the challenges of providing medical services to a sparsely populated state. The cost of transport is another major factor, as the vast distances between cities and the harsh winter weather require residents to spend more on fuel, vehicle maintenance, and specialized equipment. While the state has a relatively low income tax and a healthy budget surplus thanks to its energy reserves, the daily cost of groceries and consumer goods can be higher because of the logistics required to reach northern markets. North Dakota offers a high degree of economic security for those in the energy and agriculture sectors, but the financial reality of living there involves a constant balance against the high costs of logistical and environmental challenges.

Minnesota Quality And Expense

Minnesota is frequently ranked as one of the best states to live in for quality of life, but this excellence comes with a price tag that places it firmly among the more expensive states in the Midwest. The Twin Cities of Minneapolis and St. Paul offer a vibrant mix of culture, industry, and education, but the cost of housing in these areas has risen steadily as the region attracts more professional talent. The state is known for its high-quality public services and an extensive network of parks and schools, all of which are funded by a robust and progressive tax system. While residents benefit from these amenities, the state income tax is one of the highest in the country, which can take a significant bite out of the take-home pay for many workers.

The cost of living in Minnesota is also impacted by the state’s extreme climate, which necessitates a high spend on home insulation, heating, and winter-specific transport costs. Utilities in the North Star State are a major monthly expense for much of the year, and the cost of healthcare is also notably high, despite the presence of world-leading medical institutions like the Mayo Clinic. Additionally, while the state’s economy is diverse and resilient, the cost of childcare and higher education remains a significant burden for young families. Minnesota offers a unique and highly desirable lifestyle that emphasizes community and well-being, but the financial cost of maintaining this standard is a reality that residents must navigate with a well-managed budget and a steady income in a competitive regional market.

Georgia Growth And Inflation

Georgia has become one of the fastest-growing states in the country, but this rapid expansion has brought with it a significant increase in the cost of living that is being felt from Atlanta to the coastal islands. The capital city has transformed into a major global hub for film, tech, and logistics, leading to a massive surge in the demand for housing and a subsequent rise in real estate prices and rental rates. Neighbourhoods that were once affordable have seen rapid gentrification, making it increasingly difficult for service-sector workers to live near their places of employment. This growth has also led to some of the worst traffic congestion in the country, which adds a significant time and financial cost to the daily lives of millions of Georgians.

While the state offers a relatively low property tax rate compared to the Northeast, residents face high sales taxes and a state income tax that can add up quickly. The cost of healthcare in Georgia is another area of concern, as the state has some of the highest insurance premiums in the Southeast. Additionally, the rapid urban sprawl has led to an increased reliance on vehicles, making fuel costs and car maintenance a major part of the average household budget. Despite these challenges, Georgia remains a popular destination because of its diverse economy and its reputation as a business-friendly environment. However, the days of Georgia being a bargain-basement option for those leaving more expensive states are largely over, as the “New South” economy continues to drive prices toward the national average and beyond.

North Carolina Popularity Premium

North Carolina has experienced a similar trajectory to its southern neighbour, with its popularity as a relocation destination leading to a “popularity premium” that is driving up the cost of living across the state. The Research Triangle area, which includes Raleigh, Durham, and Chapel Hill, has become a powerhouse for biotech and technology, attracting high-earning professionals and pushing housing prices to record levels. Similarly, the city of Charlotte has cemented its status as a major financial hub, leading to a competitive real estate market that has made homeownership a challenge for many first-time buyers. The state’s natural beauty, from the Smoky Mountains to the Outer Banks, continues to draw retirees and tourists, further increasing the demand for land and services.

Beyond housing, North Carolina residents are feeling the effects of inflation in the cost of groceries and utilities, which have seen steady increases over the past several years. The state has a flat income tax rate, which provides some predictability for taxpayers, but the cost of maintaining a rapidly expanding infrastructure means that local taxes and fees are often on the rise. Transport costs are also a significant factor, as the state’s geographic diversity requires long commutes for many workers who cannot afford to live in the expensive urban centres. Healthcare in North Carolina is generally of a high standard, but the cost of access is rising, particularly in the more remote mountainous and coastal regions. North Carolina offers a wonderful quality of life with a mix of modern industry and traditional charm, but the financial reality of living there now requires a much more robust income than in previous decades.

The reality of living in these high-cost states often means that the survival of local communities depends heavily on the presence of a single major employer or industry, which can leave the region vulnerable if that sector faces a downturn.

Like this story? Add your thoughts in the comments, thank you.