When Unicorn Valuations Collapsed Almost Overnight

The dream of building a “unicorn” is a powerful motivator in the modern business world, yet the journey from a billion-dollar valuation to a total collapse is often shockingly short. We have seen a remarkable era where venture capital flowed like water, allowing companies to reach staggering heights based on promise rather than profit. However, when the economic tide turns or internal scandals emerge, these massive structures can crumble with a speed that leaves investors and employees in a state of absolute disbelief. Understanding these failures is not just about dissecting bad luck, but rather about seeing the recurring patterns of over-ambition and the dangerous allure of growth at any cost.

These stories serve as a vital reminder that a high valuation is merely a snapshot of potential rather than a guarantee of permanence. As we look back at the most significant startup collapses of recent years, we find tales of technological over-promises, ethical lapses, and the harsh reality of market saturation. This exploration matters because it highlights the fragile nature of innovation in a high-stakes environment. By examining how these giants fell, we can better understand the importance of sustainable business models and the necessity of transparency in an age where hype often outpaces the actual reality of a product’s viability.

The Tragic Fall Of Theranos

Elizabeth Holmes once stood as the celebrated face of a medical revolution with her promise of comprehensive blood testing from a single drop. The company reached a peak valuation of nine billion dollars as investors flocked to support a technology that claimed to make healthcare more accessible and less painful for everyone. However, the veneer of success began to crack in October 2015 when investigative reports revealed that the proprietary devices were wildly inaccurate and that the firm was actually using traditional machines from competitors to run most of its tests. This deception triggered a cascade of federal investigations and lawsuits that eventually led to the total dissolution of the company and a high-profile criminal trial for its primary leaders.

The collapse was not just a financial failure but also a massive breach of public trust that sent shockwaves through the entire Silicon Valley ecosystem. By 2018, the firm had officially shut down its operations, leaving behind a trail of empty laboratories and a cautionary tale about the dangers of “fake it until you make it” culture in the medical field. The downfall resulted in Holmes being sentenced to prison and serves as a stark reminder that even the most well-funded ventures cannot survive without a foundation of scientific integrity. It remains the most famous example of how a unicorn can vanish almost overnight when its core product is proven to be an elaborate work of fiction rather than a functional innovation.

The Rapid Decline Of WeWork

At its height, the co-working giant was valued at a staggering forty-seven billion dollars and was spearheaded by the charismatic but controversial Adam Neumann. The company expanded at a breakneck pace by leasing massive amounts of office space globally and attempting to brand itself as a tech firm rather than a traditional real estate business. The wheels began to fall off in 2019 when the company attempted to go public and the filing documents revealed massive losses along with deeply concerning governance issues. Investors quickly lost faith in the business model because it relied on short-term memberships to pay for long-term leases, which created a financial vulnerability that was impossible to ignore once the initial hype faded away.

The situation spiralled further as Neumann was forced to step down with a massive payout while the company’s valuation plummeted to a tiny fraction of its former glory. Though the firm attempted various restructuring efforts, the onset of the pandemic and the shift toward remote work dealt a final blow to its traditional office-centric model. By the time the dust settled, the story of this startup had become a symbol of venture capital excess and the folly of ignoring fundamental unit economics in favour of rapid expansion. It proved that even with billions in backing from major global funds, a company cannot survive if its expenses consistently and dramatically outweigh its ability to generate actual revenue from its core operations.

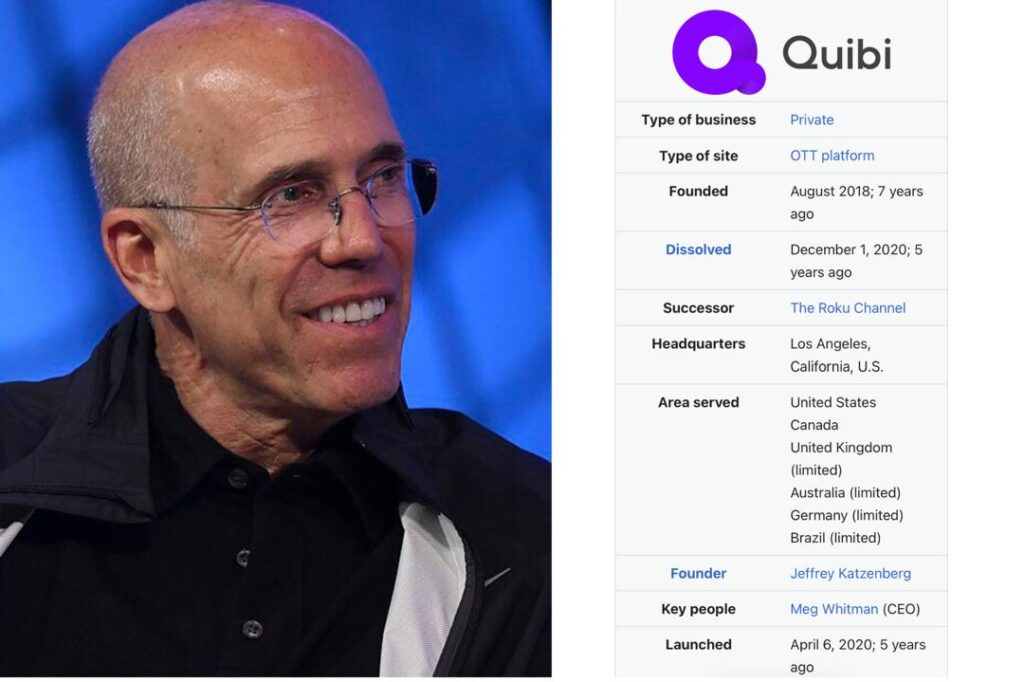

The Sudden End Of Quibi

Jeffrey Katzenberg and Meg Whitman launched this short-form streaming service with nearly two billion dollars in funding and a plan to change how people consumed content on their mobile phones. The platform focused on high-quality “quick bites” of video that were designed to be watched in ten minutes or less while people were on the move or commuting. Despite having a roster of A-list Hollywood stars and a unique technology that allowed video to flip seamlessly between vertical and horizontal views, the timing of the launch in April 2020 was incredibly unfortunate. The global lockdowns meant that the mobile-first audience was suddenly stuck at home with access to much larger screens and established streaming giants like Netflix or Disney+.

The service struggled to gain any real traction and failed to meet its ambitious subscriber targets within the first few months of operation. By October 2020, just six months after its debut, the leadership announced that the platform would be shutting down entirely and returning what remained of the capital to investors. This failure demonstrated that even with massive financial resources and industry expertise, a product must solve a genuine problem or fit into the consumer’s lifestyle to succeed. It was a humbling moment for many in the entertainment industry and showed that the market for mobile-only premium content was far smaller than the founders had originally anticipated during their initial pitch meetings.

The Shocking FTX Liquidation

The cryptocurrency exchange once seemed like the most stable and regulated entity in the digital asset space and reached a valuation of thirty-two billion dollars. Founded by Sam Bankman-Fried, the firm used aggressive marketing and sports sponsorships to become a household name and a gateway for millions of retail investors. The house of cards collapsed in November 2022 when reports suggested that the exchange was using customer funds to bail out its sister trading firm, Alameda Research. This sparked a massive “bank run” as users rushed to withdraw their holdings, but the exchange simply did not have the liquid assets to cover the requests, leading to a total halt in operations and a filing for bankruptcy.

The aftermath revealed a chaotic internal management structure and a complete lack of financial oversight that shocked even the most cynical industry observers. Bankman-Fried went from a billionaire philanthropist to a criminal defendant almost instantly as federal prosecutors moved to charge him with massive fraud and money laundering. The collapse wiped out billions in customer wealth and triggered a prolonged “crypto winter” that saw the entire market lose significant value and credibility. It serves as a devastating example of how quickly a financial giant can disintegrate when it is built on a foundation of misappropriated funds and deceptive accounting practices. The legal proceedings continue to highlight the sheer scale of the negligence that allowed such a massive enterprise to fail so spectacularly in the public eye.

The Jawbone Financial Struggle

Once a leader in the wearable technology and Bluetooth speaker market, this company was valued at over three billion dollars and was considered a pioneer in the early “Internet of Things” era. The firm enjoyed significant success with its stylish Jambox speakers and Up fitness trackers, which were praised for their design and user interface. However, the company faced intense pressure from rivals like Fitbit and eventually Apple, who were able to produce similar products at scale with more integrated ecosystems. Internal issues including manufacturing delays and high rates of product returns began to drain the company’s cash reserves while it simultaneously engaged in expensive, long-running legal battles against its primary competitors over trade secrets.

By 2017, the company began a liquidation process after failing to find a buyer or secure further funding to keep its operations afloat. The brand that once defined the sleek look of modern tech gadgets was essentially dismantled, and its founder moved on to a new healthcare-focused venture. The failure was particularly notable because the firm had raised nearly one billion dollars in debt and equity over its lifetime, yet it could not pivot fast enough to stay relevant in a maturing market. It highlights the difficulty of maintaining a hardware business when consumer tastes shift rapidly and larger tech giants decide to enter the same space with superior distribution networks and deeper pockets for research and development.

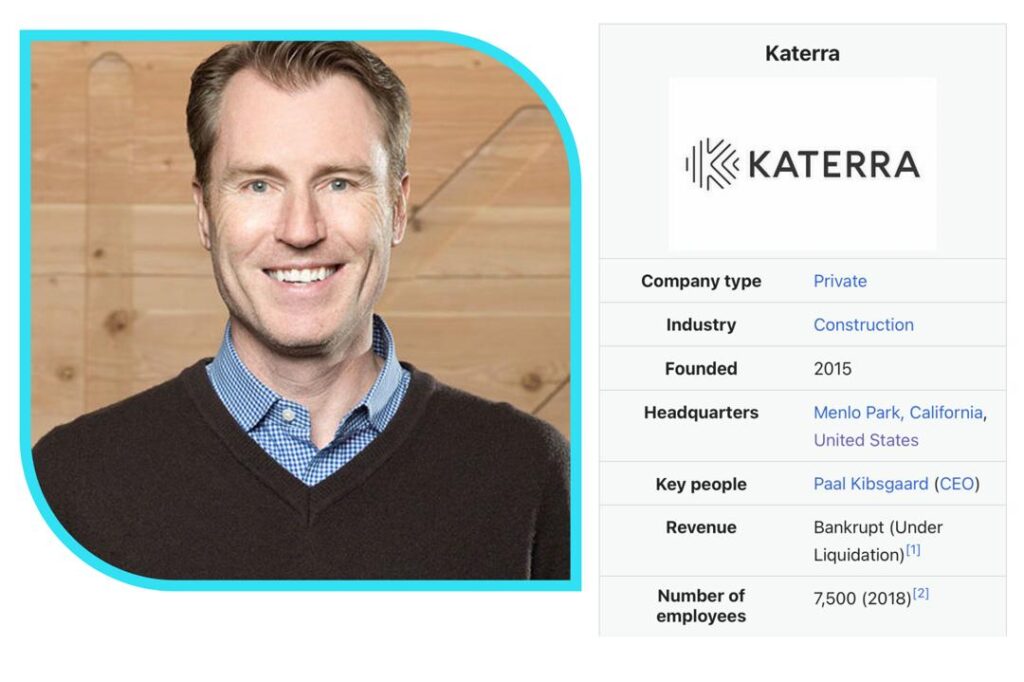

The Katerra Construction Crisis

This venture-backed startup aimed to revolutionise the construction industry by bringing a “tech-first” approach to building apartments and commercial structures. With over two billion dollars in funding primarily from SoftBank, the company reached a valuation of four billion dollars and promised to use off-site manufacturing to make construction faster and cheaper. The firm aggressively acquired smaller construction companies and invested heavily in massive factories, but it struggled with the immense complexity of integrating these disparate businesses into a single streamlined operation. Many projects faced significant delays and cost overruns, which directly contradicted the core value proposition that the company had used to attract its investors and clients.

The financial strain became unbearable by 2021 as the company dealt with the fallout of the pandemic and internal accounting irregularities that led to a loss of investor confidence. In June of that year, the firm filed for bankruptcy and announced that it would be shutting down its operations, leaving many unfinished projects and thousands of employees in a state of uncertainty. This collapse underscored the immense difficulty of disrupting an industry as fragmented and physically demanding as construction through sheer capital alone. It proved that software-style scaling does not always translate well to the physical world of bricks and mortar, especially when the underlying operational foundations are not properly managed or monitored by the leadership team.

The Fast Checkout Failure

This e-commerce startup promised to simplify the online shopping experience with a “one-click” checkout button that would rival the convenience of Amazon across the rest of the internet. After raising hundreds of millions of dollars and reaching a valuation of over one billion dollars, the company became a darling of the fintech world. However, the business model was under constant pressure as it struggled to generate significant revenue and faced intense competition from more established players like PayPal and Stripe. In early 2022, the company made the shocking announcement that it was shutting down entirely, despite having recently raised a massive round of funding that suggested a long runway for growth.

The closure was particularly abrupt and left many employees and partners wondering how a company with so much momentum could disappear in a matter of days. Reports later surfaced suggesting that the firm’s actual transaction volume and user base were significantly lower than what had been projected to investors during fundraising rounds. This case study serves as a stark warning about the risks of over-inflated growth metrics and the volatility of the fintech sector when the market moves away from a growth-at-all-costs mindset. It showed that even a clever product with a great user experience cannot survive if the underlying business mechanics and transparency with stakeholders are not held to the highest possible standards of accuracy.

The Veev Real Estate Exit

Another casualty of the attempt to modernise the construction industry was this firm, which focused on using high-tech materials and pre-fabricated panels to build homes more efficiently. Valued at over one billion dollars, the company attracted significant interest by promising to reduce the environmental impact of building while also cutting down the time required to finish a house. The startup built several impressive projects and seemed to be on a path toward significant growth in the housing-starved California market. However, the high costs of maintaining sophisticated manufacturing facilities combined with rising interest rates created a financial environment that was increasingly hostile to capital-intensive hardware startups in the real estate sector.

By late 2023, the company informed its staff that it would be shutting down its operations because it had failed to secure the necessary capital to continue its expansion. The sudden collapse was a blow to those who believed that technology could solve the global housing crisis by making construction more like a predictable assembly line. It highlighted the extreme vulnerability of startups that require massive amounts of upfront investment before they can reach a point of profitability or sustainable scale. The story of this firm serves as a reminder that even the most noble and innovative ideas can be derailed by the harsh realities of the global economic climate and the high cost of physical infrastructure.

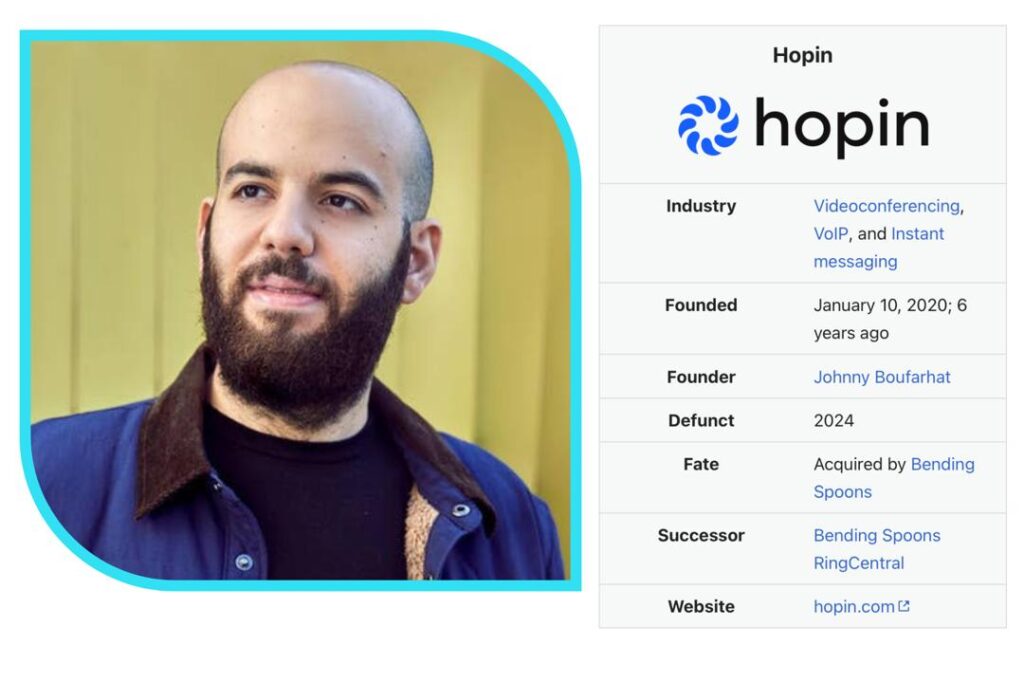

The Hopin Virtual Shift

During the peak of the pandemic, this virtual events platform became one of the fastest-growing startups in history as it reached a valuation of nearly eight billion dollars in record time. As the world moved to remote work and digital gatherings, the service became an essential tool for companies looking to host conferences and networking sessions online. The founder was celebrated as a visionary, and the company raised hundreds of millions of dollars to expand its team and acquire other businesses in the event space. However, as the world began to reopen and people returned to in-person meetings, the demand for purely virtual event software began to decline much faster than the company had anticipated.

The firm was forced to undergo multiple rounds of layoffs and eventually made the difficult decision to sell off its core technology assets to another company in 2023 for a fraction of its peak valuation. This transition marked a significant fall from grace for a company that was once seen as the future of human connection in the digital age. It serves as a classic example of a “pandemic darling” that struggled to adapt its business model once the unique conditions that fueled its growth had fundamentally changed. The story illustrates the danger of scaling a business based on a temporary market anomaly and the difficulty of maintaining a high valuation when the core customer behavior reverts to historical norms.

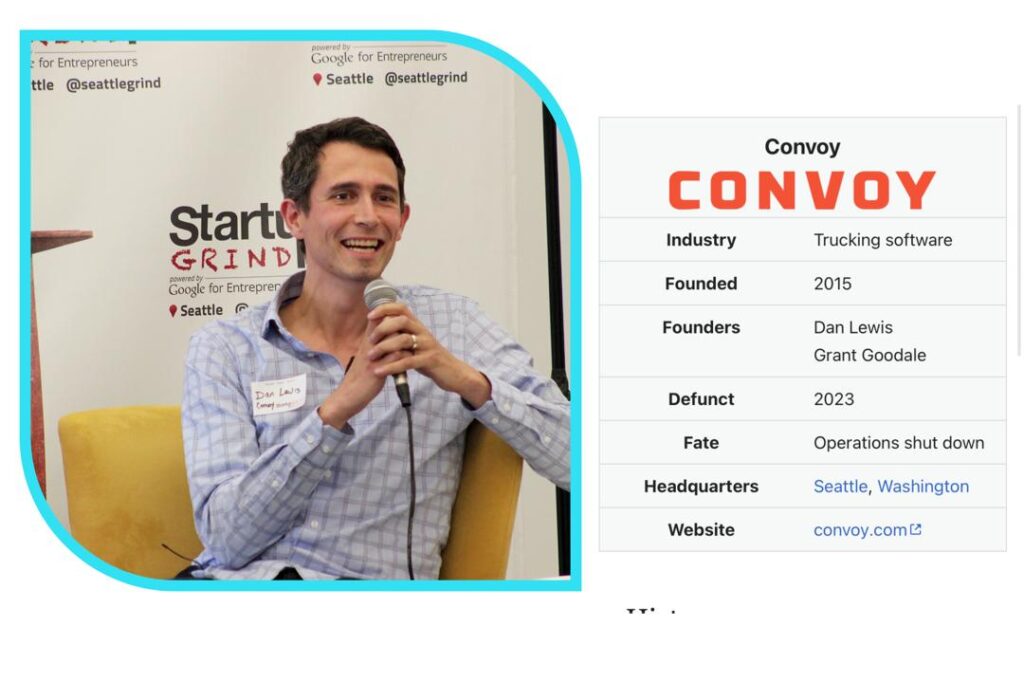

The Convoy Logistics Crisis

This digital freight network was often described as the “Uber for trucking” and reached a valuation of nearly four billion dollars by promising to use software to match shippers with carriers more efficiently. Backed by high-profile investors like Jeff Bezos and Bill Gates, the company aimed to reduce “empty miles” and improve the environmental footprint of the massive logistics industry. Despite making significant progress and building a sophisticated platform, the company was hit hard by a “freight recession” that saw shipping volumes drop and costs rise across the board. The firm found itself in a difficult position as it tried to balance the high costs of its technology development with the dwindling margins of the physical trucking market.

In October 2023, the company abruptly told its employees that it was shutting down its core operations after failing to find a buyer or secure a new line of credit. The collapse was a significant shock to the Seattle tech scene and the broader logistics world, as the company had been seen as a leader in the digital transformation of shipping. It showed that even with the best technology and the most prestigious backers, a startup remains highly vulnerable to the cyclical nature of the industries it serves. The downfall of this venture proved that being a middleman in a low-margin industry is incredibly difficult when the economy cools down and the initial venture capital funding begins to run dry.

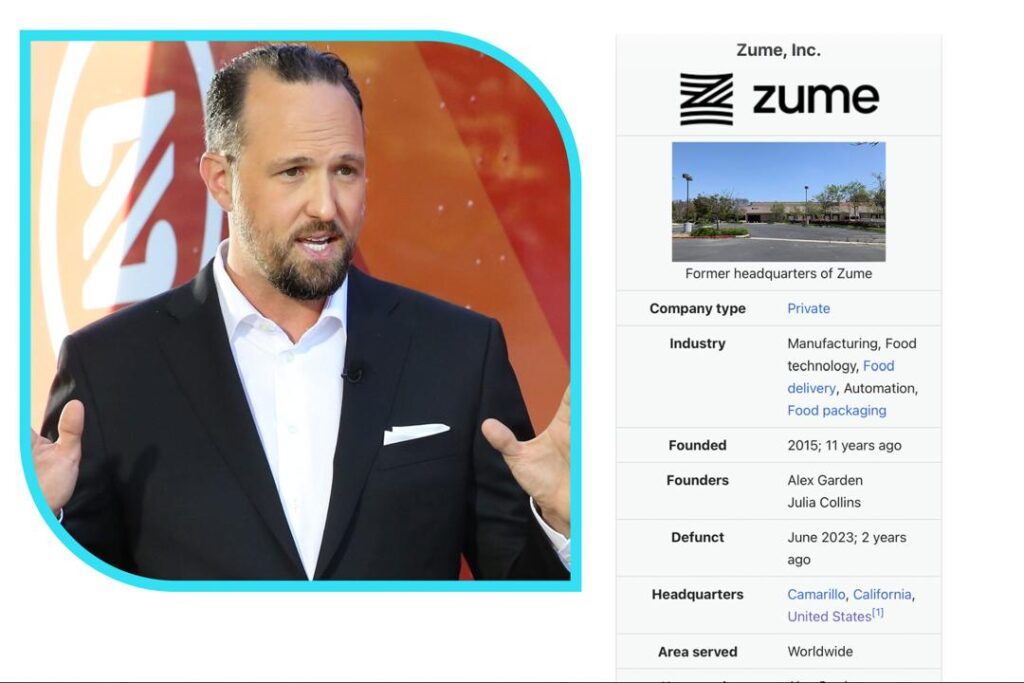

The Global Expansion Of Zume

This ambitious startup set out to automate the pizza industry by using robots to prep and bake pies inside delivery trucks while they were en route to customers. With a massive three hundred and seventy-five million dollar investment from SoftBank, the company reached a valuation of over two billion dollars and was hailed as the future of food technology. The concept of “baked-on-the-way” promised a fresher product and lower labor costs, but the engineering challenges of keeping heavy ovens and robotic arms stable in a moving vehicle proved to be far more difficult than the founders initially expected. Frequent mechanical failures and the sheer cost of maintaining a fleet of high-tech trucks meant that the company struggled to achieve the efficiency required to compete with established pizza chains.

As the technical hurdles mounted, the firm attempted to pivot away from pizza delivery toward sustainable food packaging and general automated production for other brands. However, this shift failed to capture the same level of investor enthusiasm or market demand, leading to several rounds of significant layoffs and a dwindling cash reserve. By June 2023, the company finally reached the end of its road and began the process of insolvency after failing to find a viable path to profitability. The story of this venture serves as a quintessential example of “over-engineering” a simple problem and shows that adding complex robotics to a traditional business model does not always result in a better consumer experience or a more sustainable bottom line.

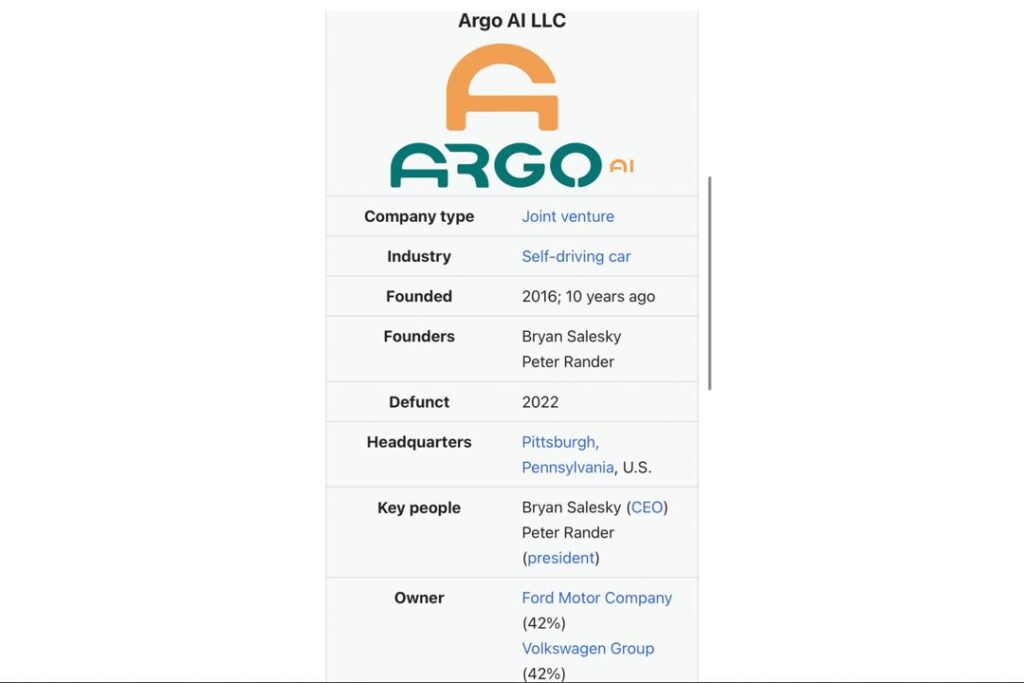

The Sudden Stall Of Argo AI

Backed by the combined industrial might of Ford and Volkswagen, this autonomous driving startup was once valued at over seven billion dollars and employed some of the brightest minds in the robotics field. The company was tasked with developing the sophisticated software and hardware systems required to bring fully self-driving vehicles to the masses within a few short years. For a long time, it appeared that the firm was making steady progress with test vehicles roaming the streets of several major American cities and positive reports regarding its sensor technology. Yet, the massive financial requirements of developing Level 4 autonomy began to weigh heavily on its corporate parents, especially as the timeline for commercial deployment continued to slip further into the future.

In late 2022, the automotive world was stunned when Ford and Volkswagen both announced they would be pulling their support, leading to the immediate closure of the startup. The decision was driven by the realization that profitable, large-scale autonomous driving was still many years away and required billions more in investment that the carmakers preferred to spend on their electric vehicle transitions. This collapse highlighted the “trough of disillusionment” in the self-driving sector and proved that even multi-billion-dollar backing cannot overcome the immense technical and regulatory hurdles of replacing a human driver. It remains a sobering reminder that some of the most hyped technologies of the decade are far more difficult to master than the initial wave of optimistic venture capital suggested.

The Bird Scooter Market Correction

When electric scooters first landed on city pavements, this company became the fastest startup ever to reach a one-billion-dollar valuation, sparking a global craze for “micro-mobility” solutions. Investors poured more than nine hundred million dollars into the venture as it expanded at an incredible speed into hundreds of cities across the world. The business model relied on the idea that these scooters would become a permanent fixture of urban transport, but the reality was a constant battle against local regulations, high rates of vandalism, and the short lifespan of the hardware itself. The company faced a constant need for fresh capital to replace broken units and fight legal battles, which became an unsustainable cycle as the initial novelty began to wear off for many riders.

The firm eventually went public via a SPAC merger, but its share price quickly collapsed as the market shifted its focus from growth to actual earnings. After years of struggling to fix its unit economics and facing delisting from the New York Stock Exchange, the company filed for bankruptcy in late 2023. This downfall marked the end of an era for the hyper-growth scooter trend and showed the limits of the “blitzscaling” strategy in the physical world. It demonstrated that while a product might be popular with users, it cannot survive if the cost of maintaining the service is higher than what people are willing to pay for a short ride across town.

The Olive AI Healthcare Struggles

This healthcare automation startup reached an impressive four-billion-dollar valuation by promising to use artificial intelligence to handle the mountain of paperwork that plagues the American medical system. The company’s “digital workers” were designed to automate insurance claims and billing processes, theoretically saving hospitals millions of dollars and allowing staff to focus more on patient care. The firm attracted massive investments during the pandemic as digital transformation became a top priority for healthcare executives. However, the company faced significant internal turmoil and struggled to prove that its technology was actually delivering the massive efficiencies it had promised in its marketing materials, leading to growing frustration among its client base.

By 2023, the startup was forced to sell off its core business units in a series of “fire sales” after it became clear that its expansive vision was not translating into a sustainable financial reality. The firm’s rapid rise and even faster decline highlighted the difficulty of selling complex AI solutions into a highly regulated and fragmented industry like healthcare. It also served as a warning about the risks of over-promising the capabilities of automation in sectors where accuracy and reliability are non-negotiable. The collapse of this unicorn left many wondering if the promise of AI in medicine was being hampered by startups that prioritized rapid valuation increases over the slow, steady work of building truly functional and integrated software systems.

The Instant Commerce Exit Of Getir

The “ultra-fast” grocery delivery sector was one of the most crowded and well-funded areas of the tech world, with this firm leading the charge with a valuation that once topped nearly twelve billion dollars. The company promised to deliver snacks, drinks, and household essentials to your door in as little as ten minutes, utilizing a network of “dark stores” hidden in urban neighborhoods. While the service was incredibly convenient for consumers, the cost of maintaining high-speed delivery riders and expensive warehouse space in city centers was astronomical. As inflation rose and the cost of capital increased, the massive losses generated by every single delivery became impossible for investors to ignore, leading to a sudden retreat from major international markets.

By 2024, the firm was forced to pull out of the UK, Europe, and the US entirely to focus on its home market in Turkey, representing a massive destruction of value for its global backers. This retreat signaled the end of the “convenience at any cost” era and proved that consumers were not always willing to pay the true price of such a labor-intensive service. The failure of this model across multiple continents showed that some startups were essentially subsidizing the lifestyle of their customers with venture capital, a strategy that inevitably fails when the funding environment tightens. It remains a primary example of how a global giant can be forced to shrink back to its origins almost overnight when the math of its core business model simply doesn’t add up.

The Arrival Electric Van Stall

This UK-based electric vehicle startup aimed to reinvent the way vans and buses were made by using “micro-factories” instead of traditional, massive assembly lines. The company reached a peak valuation of over thirteen billion dollars and secured a major order from UPS for ten thousand delivery vehicles, which seemed to validate its unique approach to manufacturing. However, the firm struggled to move from stylish prototypes to actual mass production, facing repeated delays and technical setbacks that drained its cash reserves. The visionary goal of building vehicles using composite materials and robotic assembly in small urban warehouses proved much harder to execute than the computer simulations had suggested to early investors.

The company went through multiple rounds of restructuring and pivoted its focus several times in an attempt to survive, but the high costs of automotive development proved too much to overcome. In early 2024, the firm officially entered administration, marking a significant blow to the UK’s green tech ambitions and the broader EV startup market. The collapse underscored the immense capital requirements of the automotive industry and the difficulty of disrupting established manufacturing processes. It showed that even with a revolutionary idea and a massive order book, a startup cannot survive if it cannot solve the practical, physical challenges of building a reliable product at scale within a reasonable timeframe and budget.

The Bitwise Industries Scandal

This California-based startup was once hailed as a hero of the “underdog” tech scene, raising over one hundred million dollars to build tech hubs and training programs in overlooked cities. Valued at over six hundred million dollars and moving toward unicorn status, the company claimed to be revitalizing local economies by teaching coding skills to people from marginalized backgrounds. The story took a dark turn in 2023 when the firm suddenly furloughed its entire staff and its founders were accused of massive financial fraud and misleading investors about the company’s actual revenue. It was revealed that the firm was in a dire financial state for much longer than anyone had realized, with millions of dollars seemingly unaccounted for.

The fallout was immediate and devastating for the communities that had come to rely on the company for jobs and economic hope. The founders were eventually hit with federal charges, and the company was liquidated, leaving a trail of empty buildings and broken promises across the Central Valley. This failure was particularly painful because it exploited a social mission to mask deep-seated operational and ethical failures within the leadership team. It serves as a reminder that “social impact” startups must be held to the same, if not higher, standards of financial transparency as any other business. The collapse of this firm remains a cautionary tale about the importance of due diligence and the danger of letting a compelling narrative blind investors to the cold, hard facts of a balance sheet.

The SmileDirectClub Financial Frown

This teledentistry company promised to disrupt the orthodontics industry by offering clear aligners directly to consumers at a fraction of the cost of traditional braces. Valued at nearly nine billion dollars at its peak, the company used aggressive marketing and retail “SmileShops” to bypass the traditional dentist’s office. While the firm initially saw massive growth, it quickly ran into a wall of regulatory challenges and intense pushback from professional dental associations who raised concerns about the safety of “DIY” teeth straightening. Furthermore, the company struggled with high customer acquisition costs and a massive debt load that became increasingly difficult to manage as its sales began to stagnate in a more competitive market.

Despite several attempts to revitalize its business model and improve its relationship with the dental community, the company filed for bankruptcy in late 2023 and announced it would be shutting down its operations entirely. This was a massive shock to the hundreds of thousands of customers who were in the middle of their treatment plans and were suddenly left without support or guidance. The collapse proved that even in the age of digital disruption, some medical procedures require a level of professional oversight that cannot be easily replaced by a mail-order box. It was a high-profile failure that highlighted the risks of the direct-to-consumer model in the healthcare space and the importance of maintaining a balance between convenience and clinical standards.

The View Smart Glass Crack

This company developed high-tech windows that could tint automatically to block heat and glare, reaching a valuation of over two billion dollars with significant backing from SoftBank. The “smart glass” was marketed as a key tool for making buildings more energy-efficient and improving the comfort of office workers, and it was installed in several high-profile corporate headquarters. However, the company faced significant manufacturing issues, including a massive recall of defective windows that cost the firm hundreds of millions of dollars to fix. These technical problems, combined with a downturn in the commercial real estate market, left the company in a precarious financial position with a rapidly depleting cash pile.

The firm eventually went public through a SPAC, but its stock price plummeted as it continued to report massive losses and struggled to meet its production targets. By early 2024, the company was forced to file for bankruptcy and seek a buyer to keep its technology alive in a restructured form. This failure illustrated the extreme difficulty of scaling a hardware-intensive business in the construction sector, where product defects can lead to catastrophic financial consequences. It showed that even a product with clear environmental benefits can fail if the manufacturing process is not perfectly refined before a massive rollout. The story of this startup is a reminder that in the world of physical infrastructure, there is very little room for error once a product is embedded into the walls of a skyscraper.

The Canoo Electric Vehicle Struggle

This electric vehicle startup gained attention for its futuristic, “pod-like” van designs and a unique subscription-based business model that aimed to change how people owned cars. Valued at over two billion dollars, the company secured partnerships with big names like Walmart and NASA, which gave it a significant amount of credibility in the crowded EV space. However, the firm was plagued by internal leadership changes, shifting business strategies, and a constant struggle to raise enough capital to begin mass production. Like many other EV startups, the company found that the “valley of death” between showing off a concept car and actually delivering thousands of units to customers was much wider than they had initially planned for.

While the company has managed to stay afloat longer than some of its peers by securing government contracts and smaller tranches of funding, its valuation has stayed at a tiny fraction of its peak. The struggle to reach meaningful production levels has left investors skeptical about its long-term viability in a market now dominated by massive incumbents like Tesla and traditional carmakers. This case study highlights the intense pressure on second-tier EV players who must compete for limited capital and supply chain resources. It serves as a stark reminder that in the automotive world, having a cool design is only five percent of the battle, while the other ninety-five percent is the grueling, capital-intensive work of manufacturing and distribution that many startups simply cannot sustain.

The collapse of these billion-dollar ventures illustrates that the ultimate failure of such giants often stems from the dangerous reliance on a single factory of hype rather than tangible, long-term value.

Like this story? Add your thoughts in the comments, thank you.