1. The Speed of Light Transactions

Ever wonder what actually happens in that split second between tapping your card and hearing that satisfying beep? Most of us just assume it is digital magic, but the reality is a massive, invisible infrastructure that keeps the global economy breathing. It is a lot more than just plastic in your wallet; it is a complex web of high speed data centers and security protocols. When you swipe, that data travels to one of these massive centers, often covering thousands of miles in milliseconds. The system is designed to handle over 65,000 transaction messages per second, ensuring your morning coffee doesn’t turn into a five minute wait for authorization. It is a testament to modern engineering that we move value across oceans in the time it takes to draw a breath.

This level of speed is what makes the modern world feel so seamless, turning complex financial handshakes into instant gratification for shoppers everywhere. It requires an incredible amount of coordination to ensure that your data does not get lost in the shuffle while traveling at such extreme speeds. Every millisecond counts when billions of people are trying to buy things at the exact same time. To give you a better idea of how this all stays upright, I have pulled together a few insights into the inner workings of the system we all rely on every day. It is a feat of physics and computer science that we rarely stop to appreciate in our daily lives because it just works so perfectly every time we need it.

2. Fortresses of Data

Behind the scenes, the physical locations where your transactions are processed look more like something out of a spy movie than an office building. These data centers are reinforced against natural disasters and even physical attacks to ensure the global economy never skips a beat. They feature massive cooling systems and redundant power supplies because if these buildings go dark, commerce effectively stops. It is a level of physical security that matches the digital encryption, creating a double layer of protection for every cent you spend. Knowing that your grocery run is backed by a literal fortress makes the whole process feel a lot more stable than just numbers on a screen.

These facilities are often hidden in plain sight, blending into the landscape to avoid unnecessary attention. They are staffed by experts who monitor the health of the network around the clock. This physical presence is the grounded reality of our digital world, proving that even the most high tech systems need a solid foundation to stay standing. It is the silent guardian of every purchase you make from dawn until dusk. When you consider the sheer scale of the operation, it is clear that the network is built to withstand almost anything the world can throw at it. This physical resilience is exactly what allows the digital side of things to feel so light and effortless for the rest of us.

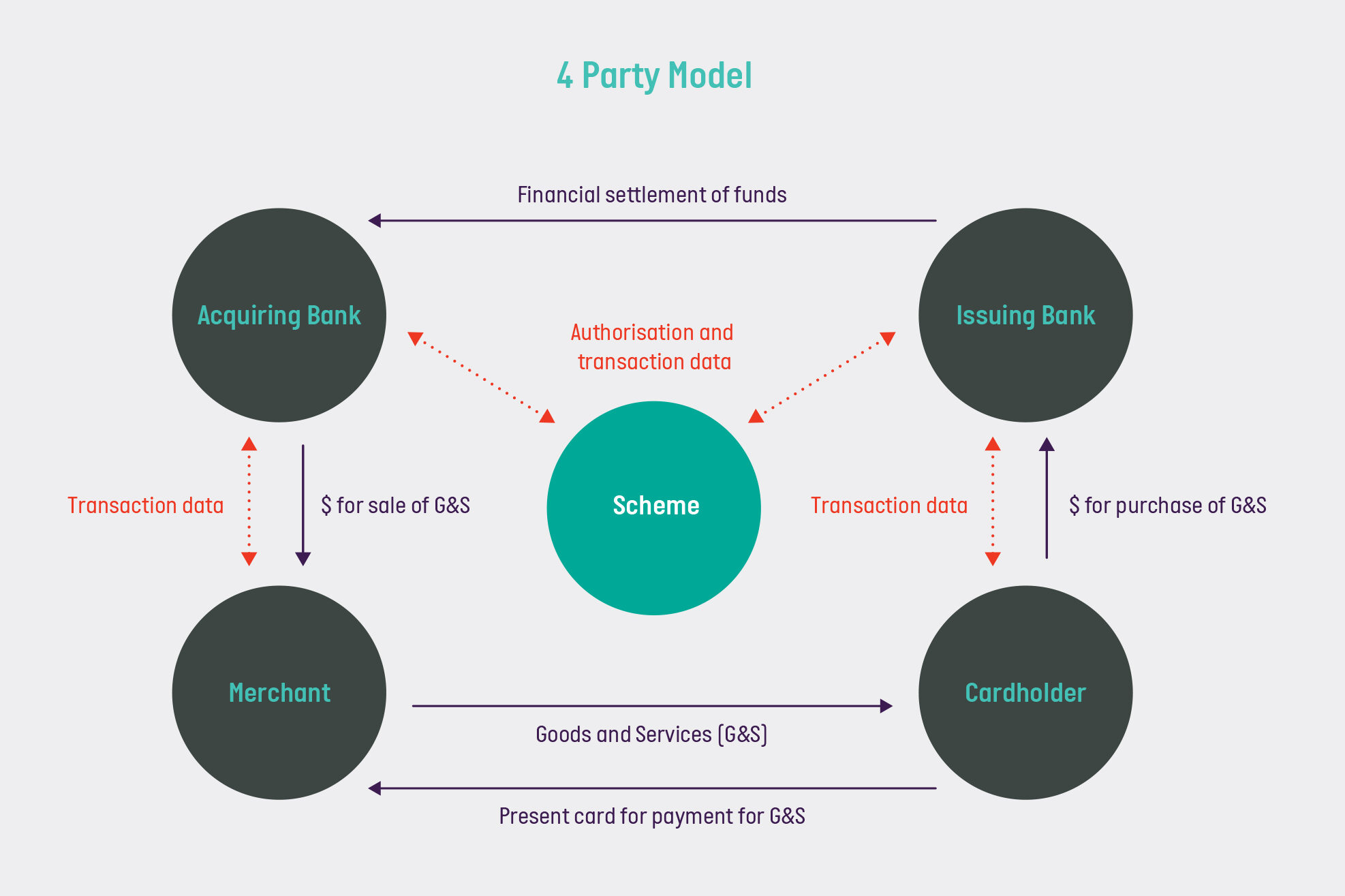

3. The Art of the Invisible Handshake

Every time you pay, there is a silent conversation happening between four different parties in an instant. This includes you, the merchant, your bank, and the merchant’s bank, all coordinated by the central network. This process, known as the four party model, is the secret sauce that allows a small cafe in Paris to trust a card issued by a credit union in Ohio. The network acts as the ultimate mediator, ensuring everyone is who they say they are and that the funds are actually there. It is a massive exercise in global trust, facilitated by code and cables, working so well that we almost never think about the complexity involved.

Each party has a specific role to play, and the network ensures they all play in harmony. This digital handshake happens billions of times a year without a single word being spoken. It is the glue that holds international commerce together, making sure that a buyer and a seller can connect regardless of where they are on the map. This invisible bond is what truly powers the global marketplace. It is a reminder that even in a world of machines, the core of the system is built on relationships and agreements. These tiny moments of cooperation are what allow us to trade with confidence across any border or language without a second thought.

4. Smart Fraud Detection

While you are busy bagging your items, an incredibly sophisticated artificial intelligence is scanning your purchase for anything suspicious. This system looks at your typical spending patterns, the location of the shop, and thousands of other data points in real time to spot a thief before they can finish the transaction. It is like having a personal bodyguard who knows your habits better than you do, stepping in only when something feels off. This silent vigilance prevents billions in potential losses every year without slowing down the honest shopper. It is a balance of high tech surveillance and user convenience that keeps the entire ecosystem from crumbling under the weight of digital bad actors.

The AI learns from every transaction, becoming smarter and more accurate with each passing second. It can distinguish between a legitimate vacation purchase and a fraudulent attempt in an instant. This protective layer is constantly evolving to stay ahead of increasingly clever scammers. It gives us the confidence to swipe our cards anywhere in the world, knowing that there is a sophisticated brain watching our backs and keeping our hard earned money safe. This proactive defense is one of the most important parts of the network, as it protects both consumers and businesses from the rising tide of cybercrime. You rarely see it working, but it is always there, keeping the path clear for honest people.

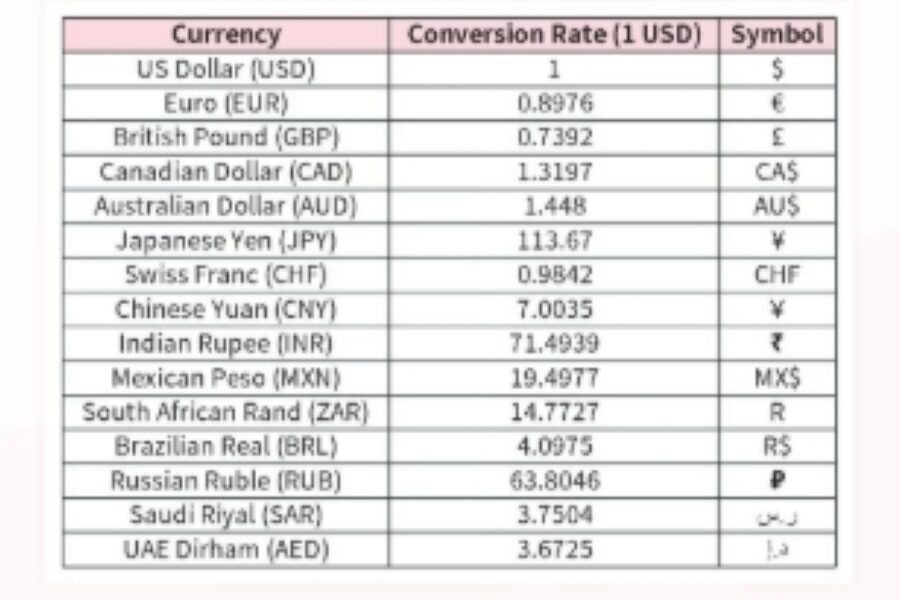

5. Currency Without Borders

One of the coolest things about this system is how it handles different currencies without you ever needing to visit a physical exchange booth. The network performs millions of currency conversions every hour, using real time rates to make sure a yen to dollar transaction is fair and fast. This bridge between different nations allows for a truly global marketplace where a creator in Indonesia can sell to a fan in Brazil effortlessly. It removes the friction of travel and international trade, making the world feel smaller and more connected. You essentially carry a universal key in your pocket that speaks every financial language on the planet simultaneously.

This capability has revolutionized the way we travel and do business across borders. No longer do we have to worry about carrying wads of local cash or getting ripped off at high interest exchange kiosks. The system handles the math and the logistics, allowing us to focus on the experience of being in a new place. It is a powerful tool for global unity, breaking down the financial walls that used to make international travel such a difficult and stressful chore. Whether you are buying a train ticket or a souvenir, the network ensures that the price you see is the price you pay, converted perfectly into the money you understand.

6. The Power of the Token

To keep your actual card number safe, the system often uses something called tokenization, which replaces your sensitive info with a random string of numbers. This means that even if a merchant’s database is hacked, the thieves only get a useless token rather than your actual account details. This layer of abstraction is why mobile wallets are so secure; your phone never actually transmits your real card number during the tap. It is a clever bit of digital sleight of hand that keeps the bad guys guessing while you enjoy convenience. It is all about making sure that even if a link in the chain breaks, your money stays locked tight.

This technology is a game changer for online shopping, where data breaches have become all too common. By using tokens, the network ensures that your most private information stays private, no matter where you shop. It is a proactive approach to security that assumes the worst so it can provide the best protection possible. This hidden layer of safety is one of the many reasons why digital payments have become the preferred choice for people all over the world. It gives us the freedom to explore new websites and apps without the constant fear of having our identity stolen. In the world of cybersecurity, this kind of innovation is the ultimate shield for everyone involved.

7. Weathering the Storm

The network is built with a zero fail mentality, meaning it has to work during hurricanes, earthquakes, and massive power outages. There are redundant systems spread across the globe so that if one region goes offline, another immediately picks up the slack without anyone noticing. This resilience is what makes electronic payments more reliable than cash in many emergency situations. It is a silent promise that the system will be there when you need it most, whether you are buying emergency supplies or just a late night snack. That peace of mind is built on decades of infrastructure investment and a deep understanding of global risk management.

Engineers spend their lives dreaming up worst case scenarios just so they can build systems to defeat them. This dedication to uptime is what allows modern society to function without constant fear of a systemic collapse. When you tap your card during a storm, you are benefiting from millions of hours of planning and preparation. It is a sturdy bridge over the uncertain waters of our world, designed to carry us through even the toughest times without ever breaking. Reliability is the silent partner of convenience, and together they ensure that our lives keep moving forward, no matter what challenges Mother Nature might throw at us. It is a truly robust piece of human engineering.

8. The Small Business Lifeline

For a long time, only big retailers could handle card payments, but the network has evolved to bring even the smallest vendors into the fold. From street performers with tap to pay units to local farmers’ markets, the barrier to entry has never been lower. This democratization of payments helps small businesses grow by allowing them to accept the same secure methods as giant corporations. It levels the playing field, giving the little guy a chance to compete in a digital first world. Seeing a hand painted sign at a fruit stand that accepts digital payments is a clear sign of how far this interconnected web has reached.

It empowers entrepreneurs to follow their dreams without being held back by outdated financial systems. By providing the tools for growth, the network is helping to revitalize local economies and support diverse business owners. This inclusivity is at the heart of the modern payment revolution, making sure that everyone has a seat at the table. It is a beautiful example of how technology can be used to uplift and empower people in every single corner of society. When a small shop can accept a payment as easily as a big store, the entire community benefits from more choice and more local flavor. It is a win for everyone.

9. Fighting for the Underbanked

It is easy to take a bank account for granted, but a huge part of the network’s mission involves reaching people who have never had access to formal finance. By partnering with mobile providers and local governments, they are helping millions of people move away from the risks of a cash only existence. This financial inclusion allows people to save securely, receive government benefits directly, and build a credit history for the first time. It is about more than just profit; it is about providing the tools for economic mobility in developing regions. Seeing how a simple digital account can change a family’s trajectory is a powerful reminder of the human side of fintech.

It provides a safety net for those who have been left behind by traditional banking systems. By expanding the reach of the network, they are helping to reduce poverty and create new opportunities for growth in developing nations. This work is essential for building a more equitable global economy where everyone has the chance to succeed. It is a mission driven approach that shows the true potential of a globally connected and highly inclusive payment system. By turning a mobile phone into a wallet, the network is opening doors that were previously locked for millions of people. This social impact is one of the most meaningful aspects of the entire operation.

10. The Evolution of the Chip

We all remember the switch from swiping to dipping, and while it felt like a chore at first, it was a massive leap in security. The tiny computer on your card creates a unique code for every single transaction, making it nearly impossible for hackers to clone your card. This move away from the static magnetic stripe has drastically reduced face to face fraud in stores around the world. It was a global coordination effort that required millions of merchants to upgrade their hardware, showing the sheer scale of the network’s influence. It is a tiny piece of tech that carries a huge responsibility for your financial safety.

This chip is actually more powerful than the computers used to send the first astronauts to the moon. It performs complex cryptographic tasks in the blink of an eye, ensuring that your transaction is authentic every single time. While it might take a second longer than a swipe, the added security is well worth the wait. It is a perfect example of how small changes in technology can have a massive impact on our daily lives. This little chip is a silent hero in the fight against financial crime, making it much harder for thieves to succeed. It is a small but mighty piece of equipment that keeps us all safe.

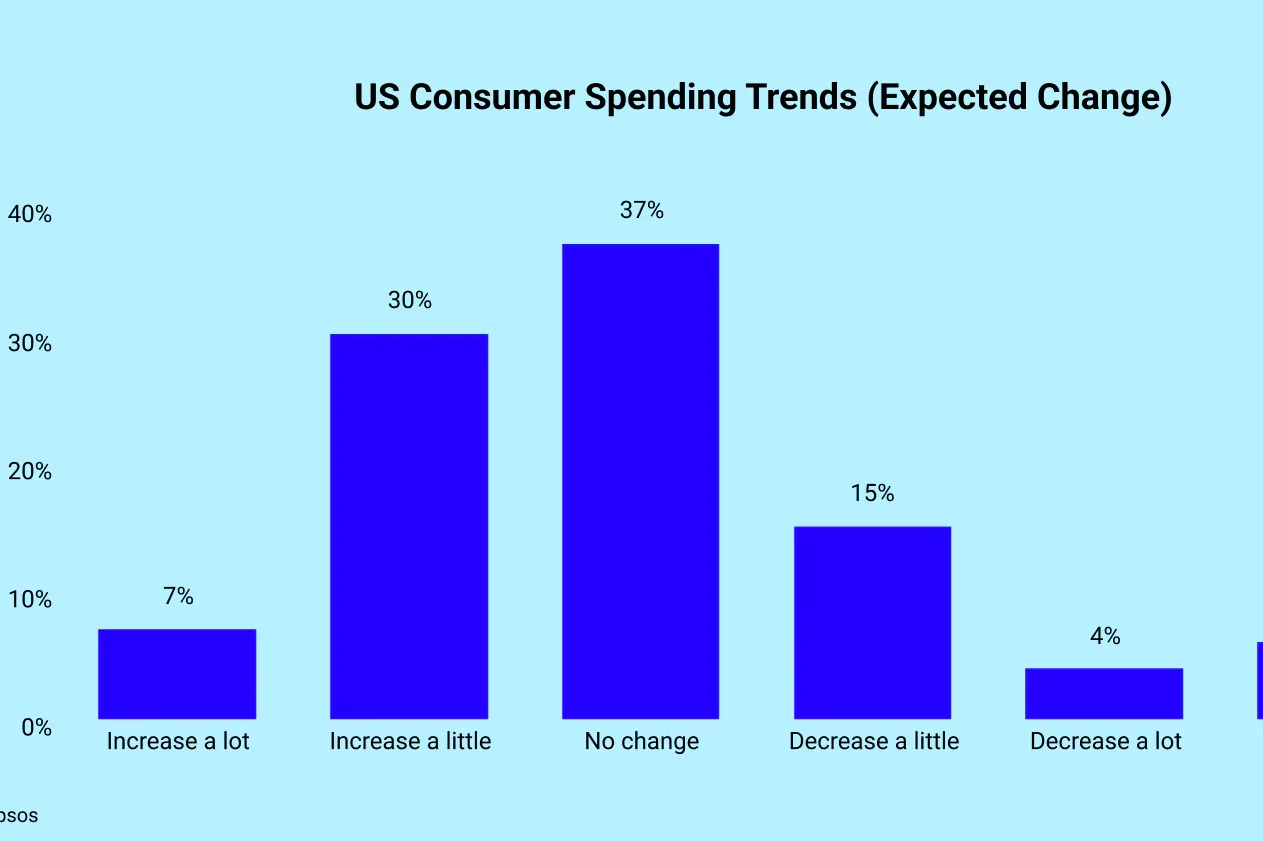

11. Real Time Insights

The massive amount of data flowing through the system does not just process payments; it also provides a pulse on the global economy. By looking at aggregated, anonymous spending trends, economists can understand how people are reacting to changes in the world in real time. This helps governments and businesses make better decisions about everything from infrastructure to inventory. It is like having a high resolution map of human behavior that helps predict where the world is headed next. While your individual privacy is protected, the collective story told by our spending habits is an invaluable tool for understanding our modern society.

It allows us to see the effects of policy changes and economic shifts almost as they happen. This data driven approach to economics is helping to create a more stable and predictable world for everyone involved. It is a fascinating use of technology that goes far beyond simple commerce and enters the realm of social science. By understanding the flow of money, we can better understand the flow of human life and work to build a brighter future for all. This bird’s eye view of the world is a unique byproduct of a system that was built just to move numbers from place to place.

12. The Green Side of Payments

Moving away from physical cash and paper checks actually has a significant environmental impact that most people don’t consider. By digitizing transactions, the network reduces the need for armored trucks, paper waste, and the energy intensive process of minting coins. They are also working toward making their own massive data centers carbon neutral, recognizing their role in a sustainable future. It is a journey toward a more efficient way of moving value that respects the planet’s resources. While a digital transaction feels weightless, the effort to make it eco friendly is a very heavy and intentional lift.

It is a reminder that even the most high tech industries have a responsibility to care for the environment. By reducing the physical footprint of money, the network is helping to build a greener world for future generations. This commitment to sustainability is an important part of their long term vision for a better planet. It shows that they are thinking about more than just the bottom line, but also about the health of the world we all share. As we move toward a cashless society, the environmental benefits will only continue to grow, making our economy more efficient and sustainable for everyone.

13. Supporting Travel and Tourism

Travelers know the stress of wondering if their money will work in a foreign land, and the network is the primary cure for that anxiety. By providing a consistent experience across 200 countries, they make it possible to explore the world with confidence. They also offer services like emergency card replacement and travel insurance that catch you when things go wrong far from home. It is a safety net that spans the globe, allowing you to focus on the experience rather than the logistics of currency. This global reliability is one of the most tangible benefits of a truly unified system.

It allows us to step out of our comfort zones and experience new cultures without the fear of being stranded without funds. The system works tirelessly in the background, ensuring that your financial life stays on track no matter where your adventures take you. It is a silent companion that gives you the freedom to roam the world with a sense of security. This global reach is what makes the network such a vital part of the modern travel experience for everyone. Whether you are in a bustling city or a quiet village, the familiar logo on your card is a promise of help.

14. The Human Touch in Tech

Even with all the AI and automation, there are still thousands of people around the world working to resolve disputes and help customers. When you call about a fraudulent charge, you are interacting with the human element of this massive machine. These teams are trained to navigate the complex rules of chargebacks to make sure you aren’t held responsible for someone else’s crimes. It is the final line of defense that gives people the confidence to spend online and in person. This human centric approach ensures that the technology serves us, rather than the other way around.

It is a reminder that at the end of every digital transaction, there are real people with real lives. The network understands that trust is built on more than just code; it is built on human connection and support. By providing a helping hand when things go wrong, they are reinforcing the bond of trust that keeps the whole system moving forward. It is a necessary and valued part of the digital experience that we should always cherish. No matter how much technology evolves, there will always be a need for human empathy and understanding to make it truly work for everyone.

15. Constant Innovation Labs

The network doesn’t just sit still; it runs dedicated innovation centers where they test the future of commerce. From biometric palm scanning to blockchain integration, they are constantly playing with the next big thing. This culture of experimentation ensures that they aren’t caught off guard by new technologies or changing consumer habits. It is a proactive stance that keeps them at the center of the financial world even as the landscape shifts beneath their feet. By staying curious, they ensure that the next way to pay will be just as secure and easy as the current one.

These labs are the birthplace of the technologies that will define our lives in the years to come. They are staffed by dreamers and doers who aren’t afraid to fail in the pursuit of something better for all. This drive for innovation is what has kept the network at the top of its game for decades. It is an inspiring look at what happens when you combine resources with a relentless passion for progress. The future of payments is being written right now in these quiet rooms, ensuring that we will always have safe and easy ways to trade value.

16. Bridging the Gap with Crypto

While some see traditional finance and cryptocurrency as enemies, the network is working to bridge the two worlds together. They are developing ways for people to spend their digital assets at millions of traditional merchants without the seller needing to know anything about the blockchain. This integration helps bring the benefits of new tech to the mainstream while maintaining the protections we all expect. It is a pragmatic approach to a complex trend, focusing on utility and safety over hype. By acting as a translator between old and new money, they are helping define the future.

This work is essential for ensuring that the benefits of blockchain technology can be enjoyed by everyone, not just the tech savvy few. It is a bridge to a more inclusive and flexible financial future where people have more choices than ever before. The network’s role as a mediator is crucial for building a world where different types of money can coexist and thrive together. It is a bold step toward a more integrated global economy that welcomes new ideas. By providing a safe path for crypto to enter the mainstream, they are helping to ensure the stability of the entire system.

17. Education and Empowerment

A big part of maintaining a healthy system is making sure the people using it are financially literate. The network invests heavily in educational programs that teach people how to budget, save, and use credit responsibly. They understand that a confident, informed customer is the best kind of user for their system. These programs reach schools, small businesses, and community centers, providing free tools to help people take control of their financial lives. It is a long term investment in the global community that pays dividends in the form of a more stable and prosperous economy.

By empowering people with knowledge, the network is helping to create a more resilient and successful society for all. This work is especially important for young people who are just starting their financial journeys and need guidance. It provides them with the skills they need to navigate the complexities of the modern world with confidence. It is a beautiful example of a company taking a holistic approach to its role in the global community. Financial literacy is the foundation of economic freedom, and by supporting it, the network is helping to build a brighter future for everyone who participates.