1. Prices Can Change Dozens of Times a Day

Amazon uses automated dynamic pricing that can update product prices many times within a single day. Algorithms respond to factors like demand, inventory levels, competitor pricing, and shopping trends rather than fixed price tags. Popular items may increase slightly during high demand, while slower-moving stock can quietly drop in price without notice. Independent price-tracking studies have shown some listings change prices multiple times in 24 hours. Amazon says it does not personalize prices for individual users, but it does react quickly to market-wide signals. That is why shoppers sometimes feel prices are unpredictable, even though the changes are driven by data, not randomness.

2. Warehouses Are Organized by Algorithms, Not Categories

Amazon fulfillment centers do not organize items by category or brand. Instead, products are placed wherever there is open space, a method known as random stow. Software tracks every item’s location, allowing systems to calculate the fastest picking routes when an order is placed. Robots move shelves to workers, reducing walking time and speeding up fulfillment. This design allows Amazon to store more items, adapt quickly to demand shifts, and process huge order volumes efficiently. What feels chaotic to humans is highly logical to machines, and that machine-first design is central to Amazon’s speed.

3. Amazon Often Positions Products Before You Order Them

Amazon analyzes browsing behavior, purchase history, wish lists, and regional trends to predict what customers are likely to buy next. Using this data, products are often moved closer to specific regions before orders are placed. This predictive inventory positioning helps explain why some items ship almost immediately after checkout. While Amazon does not publicly confirm full anticipatory shipping at scale, logistics experts widely agree that predictive placement is already active. The system reduces delivery times and lowers shipping costs by shortening the distance between inventory and buyers.

4. Amazon Web Services Quietly Powers Huge Parts of the Internet

Amazon Web Services, or AWS, is one of Amazon’s most profitable and influential divisions. It provides cloud computing services used by streaming platforms, news organizations, startups, corporations, and government agencies worldwide. Many websites and apps rely on AWS for storage, security, and processing power. Financially, AWS often generates more operating profit than Amazon’s retail business. While shoppers rarely notice it, AWS makes Amazon one of the most important technology infrastructure providers on the planet.

5. Prime Is Designed to Reshape Buying Habits

Amazon Prime is built to encourage frequent shopping by removing friction from buying decisions. Once customers pay for membership, fast shipping feels “free,” even though it is prepaid. Research consistently shows Prime members spend far more annually than non-members. Streaming, exclusive deals, and early access sales deepen loyalty and keep customers inside Amazon’s ecosystem. Over time, Prime turns Amazon into the default place to shop, not because prices are always lowest, but because convenience feels unbeatable.

6. Search Rankings Are Driven by Performance, Not Just Popularity

Amazon’s product rankings are influenced by many factors beyond raw sales numbers. Conversion rates, customer reviews, stock availability, shipping speed, and advertising all play roles. Sponsored listings appear at the top, while organic rankings reward listings that consistently lead to successful purchases. A product with strong reviews and fast fulfillment can outrank a cheaper competitor with slower shipping. This system prioritizes customer satisfaction and efficiency over simple popularity.

7. Amazon Profits From Seller Competition Either Way

More than half of Amazon’s sales come from third-party sellers. These sellers often compete fiercely with each other and sometimes with Amazon’s own brands. Regardless of who wins a sale, Amazon earns fees from listings, fulfillment, storage, advertising, and payments. Fulfillment by Amazon allows sellers to outsource logistics for a price, making Amazon central to every transaction. Competition increases Amazon’s revenue while shifting inventory risk to sellers.

8. Reviews Are Actively Policed With Automation and Humans

Amazon uses machine learning and human reviewers to detect fake or manipulated reviews. Systems analyze language patterns, posting behavior, and review timing to identify suspicious activity. The company removes reviews that violate policies and has taken legal action against fake-review brokers. While imperfect, this ongoing moderation is critical because reviews strongly influence purchasing decisions. Trust in ratings helps sustain Amazon’s marketplace credibility.

9. Delivery Routes Are Constantly Recalculated

Amazon’s delivery routes are optimized using real-time data on traffic, weather, delivery windows, and package priority. Routes can change during the day as conditions shift. This system helps drivers deliver more packages with fewer delays while reducing fuel use. The same software also informs where Amazon places delivery stations. The result is a highly adaptive last-mile network that supports tight delivery promises.

10. Most Website Changes Are Silent Experiments

Amazon runs thousands of A/B tests simultaneously, comparing different layouts, wording, and features. Users are rarely aware they are part of these experiments. Changes that improve speed, engagement, or conversion rates are quietly rolled out, while others disappear. This constant testing culture allows Amazon to improve continuously without disruptive redesigns. Many everyday features began as small experiments.

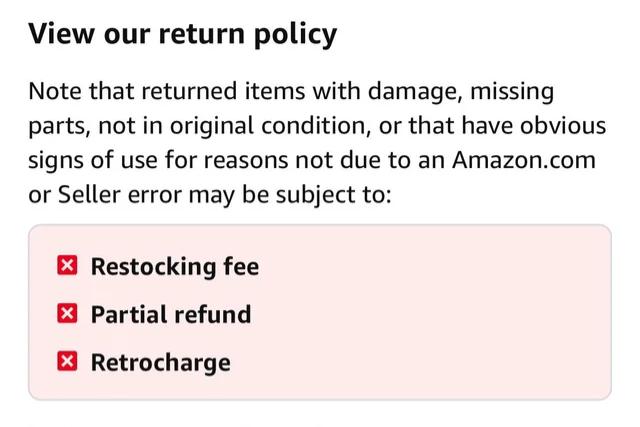

11. Returns Are Expensive and Increasingly Discouraged

Returns are costly due to inspection, repackaging, resale, or disposal. Amazon now charges certain sellers return-processing fees for high return rates. This encourages accurate listings and better product quality. Many returned items cannot be resold as new, adding to logistics and waste challenges. Returns may feel easy for shoppers, but they are a major operational burden.

12. The Buy Box Rewards Reliability, Not Just Price

Winning the Buy Box depends on more than offering the lowest price. Amazon considers fulfillment method, delivery speed, seller reliability, inventory levels, and customer satisfaction. A slightly higher-priced seller with strong performance can win over a cheaper competitor. The system aims to reduce failed deliveries and poor experiences for customers.

13. Physical Stores Support Online Speed

Amazon’s physical stores, including Whole Foods and Amazon Fresh, support faster delivery, pickups, and returns. These locations also provide valuable data on shopping behavior. Stores act as local fulfillment points, helping Amazon shorten delivery times and expand same-day service. Physical retail strengthens Amazon’s logistics rather than replacing online shopping.

14. Drones and Robots Are Still Experimental but Advancing

Amazon continues testing drones, robots, and advanced automation for delivery and fulfillment. While large-scale rollout is slow due to safety and regulatory hurdles, limited real-world trials are active. These tools are designed to handle small, fast deliveries and repetitive warehouse tasks. Humans remain essential, but automation is steadily reshaping how orders move.

The more you look behind the curtain, the clearer it becomes why Amazon feels so fast, familiar, and hard to replace.

Like this story? Add your thoughts in the comments, thank you.